AFBS Get Together 2025: Positioning in a Volatile World

On 4 June 2025 AFBS hosted its "Get Together 2025" in Zurich, Bär & Karrer AG themed "Positioning in a Volatile World". Eva Selamlar, Head of the Swiss Financial Innovation Desk FIND delivered the opening keynote about the recent Pathway 2035 publication and the future of the Swiss financial center.

The gathering also included a welcome address by Adrian Nösberger (Chair AFBS; CEO Schroder & Co Bank AG), a conversation with Joël Fischer (Bär & Karrer AG) and Ralph Kreis (AlixPartners) as well as a panel discussion featuring Enna Pariset (Deputy Chair AFBS; CEO BNP Paribas Group Switzerland), Björn Sibbern (CEO SIX Group), and Christian Kunz (Bär & Karrer AG), moderated by Lisa Osofsky (AlixPartners). The high-caliber discussions all centered around needed actions for Switzerland to enhance its attractiveness and better position itself as a key center for innovation in the financial sector.

Raoul Oliver Würgler (AFBS), Eva Selamlar (FIND), Jonathan Deneys (AFBS), Edouard Cuendet Fondation Genève Place Financière).

Source:Edouard Cuendet

Adrian Nösberger (Chair AFBS, CEO Schroder & Co Bank AG) opened the event by welcoming the audience, emphasizing AFBS's crucial role in maintaining diversity in the Swiss financial landscape, especially after the Credit Suisse takeover.

Welcome Address by Adrian Nösberger (AFBS)

Source:AFBS

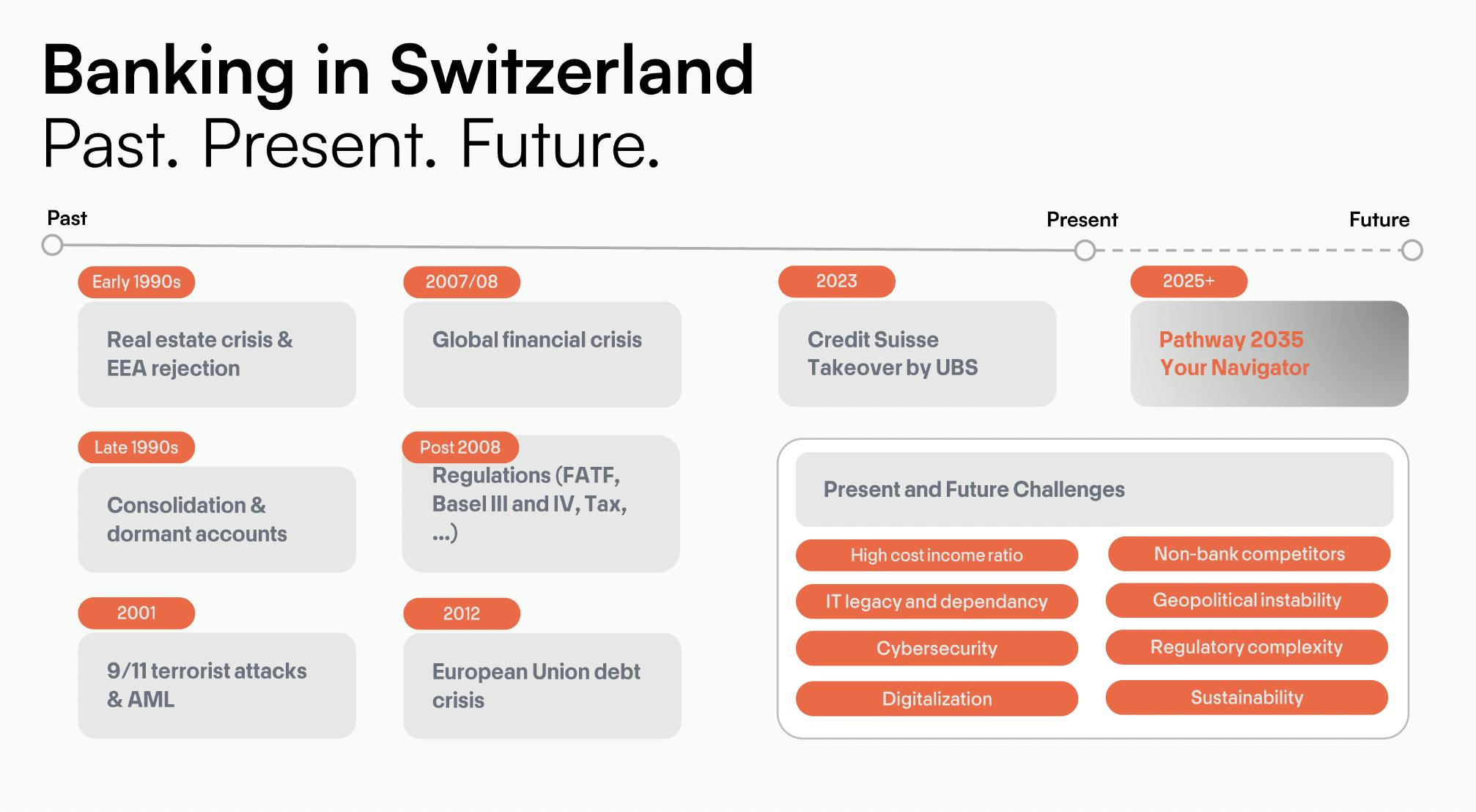

Calls to action for Switzerland’s financial sector

Eva Selamlar (Head of FIND) presented FIND's pilot mandate as a central public hub for financial innovation to strengthen the Swiss financial sector. Switzerland is often heard to lose its lead in financial innovation and FinTech, reason enough for FIND to get to the bottom of these rumors. Selamlar outlined the past, presence and future of banking in Switzerland and related challenges. In short, there have and always will be difficult times and uncertainties – important to be prepared as best as possible and to manage them. For the future she introduced "Pathway 2035 for Financial Innovation – Your Navigator", a visionary guide for financial innovation, identifying four key transformative trends: artificial intelligence (AI), digital assets, digital trust and quantum-safe technologies. She explained why the four emerging technologies are important, discussed the challenges they involve and shared insights about Switzerland’s very own pathway in view of the unique ecosystem in each field. Selamlar closed the keynote with recommendations and calls to action for Switzerland’s financial sector, namely rethinking the traditional financial sector; define a strategy and foster literacy regarding the four transformative trends; allocate resources in a timely and strategic manner; foster collaboration via partnerships and actively engage in the unique Swiss financial ecosystem.

Banking in Switzerland. Past. Present. Future.

Source:FIND

Keynote by Eva Selamlar (FIND)

Source:AFBS

Call to Action & Solutions

Source:FIND

“A Bank Is Not a Law Enforcement Agency”

The interactive audience discussion led by Joël Fischer (Bär & Karrer AG) and Ralph Kreis (AlixPartners) followed a digital online survey of the audience and highlighted their rather pessimistic market sentiment regarding Switzerland's future financial standing. The survey participants largely desired reduced regulatory burden and more clarity from the Swiss regulators. A significant portion of the audience believed new technologies, particularly AI, would be overall beneficial for the Swiss financial center despite concerns such as AI's impact on potentially reducing junior positions, highlighting the relevant question of sourcing future senior talent. The discussion also touched on whether policymakers outsource too many responsibilities to banks which was critically challenged with the statement “a bank is not a law enforcement agency."

"Conservative like a Swiss Watch"? Time to Step Out the Comfort Zone

Moderated by Lisa Osofsky (AlixPartners), a panel discussed followed, featuring Enna Pariset (Deputy Chair AFBS, CEO BNP Paribas Group Switzerland), Björn Sibbern (CEO SIX Group) and Christian Kunz (Bär & Karrer AG).

Navigating Regulation and Innovation

A significant point of discussion was the need for a balanced relationship between regulatory frameworks and innovation. Insights were shared, also referencing the FINMA guidance on stablecoins which the panelists perceived as overly strict, underscored the importance of innovation-friendly regulation to foster new advancements in digital finance. This approach highlights the value of ongoing dialogue in shaping effective regulatory environments.

The Urgency of Quantum-Safe Solutions

The critical need for financial institutions to be ready and collaborate on quantum-safe solutions was a recurring theme. The discussion stressed the importance of engaging with the broader ecosystem, including initiatives like Quantum Basel, to develop and implement these crucial security measures. It was emphasized that standards for emerging technologies, such as quantum-safe solutions, should ideally originate from collaborative efforts among academia, specialized associations and industry leaders before engaging with regulators.

The Transformative Impact of AI

The increasing integration of AI across all facets of banking, from global markets to retail operations and human resources, was a key highlight. Participants acknowledged that data protection concerns, while valid, can be effectively managed through careful and thoughtful application of AI. An illustrative example showcased how AI-powered virtual assistants could enhance the understanding of customer behavior, leading to improved decision-making and reduced contract cancellations. The rapid pace of technological change necessitates strong collaboration within the ecosystem to support the evolution of IT within banks.

Switzerland's Position in the Global Financial Arena

Observations were made regarding Switzerland's approach to innovation and its standing in the international financial community. While acknowledging Switzerland's inherent stability and neutrality as foundational to its success (“conservative as a Swiss watch”), there was a call to embrace greater agility and step out of comfort zones, drawing comparisons to more rapidly evolving markets such as Spain or Singapore. The country's robust financial infrastructure was lauded as an excellent starting point despite that this is not always recognized within Switzerland. It was suggested that Switzerland could benefit from more proactive international promotional efforts and content-based narrative. The discussion also touched upon the global competitiveness of Swiss banking, emphasizing that a significant portion of Swiss banking business derives from internationally active banks and clients. Finally, the topic of initial public offerings (IPOs) was raised, with an observation that contrary to other European jurisdictions, many successful Swiss small and medium-sized enterprises (SMEs) do not go public, actually limiting their growth potential.

Panel Discussion by Christian Kunz (Bär & Karrer AG), Enna Pariset (Deputy Chair AFBS/BNP Paribas) and Björn Sibbern (Six Group), moderated by Lisa Osofsky (AlixPartners).

Source:AFBS

Raoul Oliver Würgler (Secretary General AFBS) delivered the closing remarks, expressing gratitude to the audience, speakers, panellists, the AFBS Board, Bär & Karrer AG and AlixPartners. He highlighted that AFBS represents over 16,000 employees in Switzerland and offers a wide range of services from retail to corporate services.

The ecosystem in the financial innovation space in Switzerland is extremely dense, fast-pacing and has a lot to offer in terms of collaboration and synergies opportunities. The AFBS get-together 2025 has proven this strongly. FIND looks forward to continuing the dialogue and encourages the ecosystem to reach-out with ideas, concerns and any other feedback (email to info@find.swiss).