Introduction and Opening Remarks

The conference "Crossborder Financial Services – Is this the End?", held in Zurich on 5 May 2025, brought together academics and professionals to discuss the evolving landscape of crossborder financial services. Organised by the Center for Financial Market Regulation at the University of Zurich (UZH) and the European Banking Institute (EBI) Frankfurt, the event addressed the increasing challenges to crossborder financial services, particularly for Switzerland, in light of evolving EU regulations and geopolitical instability, aiming to analyse the situation, discuss strategic options, and propose a call for action.

At the time, the entry into force of the General Agreement on Trade in Services (GATS) and its Annex on Financial Services in 1997 had raised high hopes for a progressive liberalisation of the crossborder trade in financial services. A quarter of a century later, progress has not only stalled but is in fact being reversed. This trend, emerging long before the Trump administration’s tariff announcements on trade, has reached a new peak with the Regulation on Markets in Crypto-Assets (MiCAR) and the new EU Capital Requirements Directive (CRD VI) which are effectively shutting down certain types of crossborder services. On the other hand, the Berne Financial Services Agreement (BFSA) between Switzerland and the United Kingdom, expected to enter into force at the beginning of 2026, is an example of a new type of bilateral agreement that tries to facilitate market access while providing safeguards for consumers and financial stability.

Professor Michael Schaepman, President of the University Zurich (UZH); Professor of Remote Sensing, opened the conference by welcoming academic and professional attendees by highlighting the significance of (crossborder) financial services to Switzerland. He emphasised the increasing relevance of crossborder services and acknowledged the growing impact of digitalization on global exports. He quoted Professor Ralph Ossa, Department of Economics UZH, Chief Economist at the WTO, with “precisely because of international trade in goods is currently dominating the headlines, it is all the more important to raise awareness of the structural significance of trade in services, especially in the financial sector where digitalisation, standardisation and new platforms greatly facilitate crossborder exchange. In a fragmented global environment these varied areas may well become key drivers of future trade integration”.

Michael Schaepman

Source:FIND / Marco Leisi

Professor Christos Gortsos, President of the Academic Board of the European Banking Institute (EBI), provided background on the EBI, a network of 70 universities in Europe dealing with financial regulation in banking, capital markets and insurance. He stressed that “the topic […] has a global dimension and has ramifications which go beyond the current discussions about trade wars.”

Professor Rolf Sethe, Professor of Civil, Commercial and Business Law; Co-Director Center for Financial Market Regulation, University of Zurich (UZH) also welcomed participants and introduced the day's program and sessions.

Christos Gortsos

Source:FIND / Marco Leisi

Current Status of Crossborder Financial Services under EU Law

Professor Rolf Sethe opened the first session of the conference on the challenging regulatory framework governing crossborder financial services within the European Union (EU). The session was divided into two parts, offering distinct yet complementary perspectives on the topic.

Part 1: Professor Rolf Sethe

Professor Rolf Sethe initiated this part by addressing fundamental definitional questions, clarifying the EU's perspective on what constitutes a "third country" or “reverse solicitation” and delineating the concept of "crossborder" financial services, wherein the financial service itself crosses the border, rather than the service provider. He presented a historical timeline of EU market access regulations, from the pre-2005 period with no limits to the more restrictive MiFID I, MiFID II and the recent CRR III/CRD VI and MiCAR regulations. He provided a balanced analysis of the advantages and disadvantages of liberal market access, weighing the benefits of market expansion, increased liquidity, innovation, and competition against the potential dangers of externalities for the single market, regulatory arbitrage, and distortion of competition. A significant portion of Professor Sethe's presentation was dedicated to a detailed examination of the third-country regime established by MiFIR/MiFID II and the two-part approach of providing services to professional or retail clients in accordance with the principle of proportionality. He outlined the requirements for providing services to professional clients, emphasising the principle of equivalence of third-country supervision. He contrasted these with the more stringent requirements for serving retail clients, such as the branch requirement, the strict compliance with investor protection measures and the obligation to join an investor compensation scheme. Professor Sethe criticised the EU approach as: “Crossborder financial services face major obstacles under current EU regulation which cannot be justified by the objectives of investor protection or financial stability”. He concluded that with obstacles like branch requirements, lack of political will for granting equivalence, lack of European passporting rights and ultimately a disproportionate burden for smaller financial firms that MiFIR/MiFID II is in practice no success. Due to the European Commission's non-granting of equivalence to third countries, crossborder financial services are, in effect, still governed by national laws. These obstacles led to situation that only around 50 third-country firms (mostly banks with branches) opened a branch in the EU. A subsidiary is by far a better solution for third-country firm. He characterized the EU's approach as de-facto protectionist, thereby raising important questions about the long-term implications for the competitiveness and efficiency of the European financial market.

Rolf Sethe

Source:FIND / Marco Leisi

Part 2: Professor Matthias Lehmann

Professor Matthias Lehmann’s, Professor of Comparative Law, Uniform and International Law, University of Vienna; Professor of European and Comparative Business Law, Radboud University, Nijmegen, presentation build upon Professor Sethe's analysis and delved into the specifics of CRD VI and MiCAR, two key regulatory initiatives shaping the landscape of crossborder financial services in the EU. He explained how CRD VI serves to transpose the Basel IV framework into EU law, with a particular focus on regulating the access of third-country banks to the EU market. CRD VI will become fully effective on 11 January 2027. Professor Lehmann detailed the branch requirements imposed by CRD VI, containing capital and liquidity requirements, internal governance and risk management expectations, and booking requirements. He highlighted that CRD VI is not harmonizing EU law as it defines merely minimum requirements, still allowing individual member states to impose additional, potentially more stringent conditions, thereby creating a fragmented regulatory landscape and further restricting market access for foreign banks. Professor Lehmann concluded that the CRD VI is pulling up the drawbridge for third country banks.

Shifting the focus to MiCAR, Professor Lehmann discussed the regulation’s overarching goals, which include promoting innovation in crypto-asset technologies, ensuring investor protection, promoting market integrity, facilitating smooth payment systems, safeguarding monetary sovereignty and financial stability. He provided a comprehensive overview of MiCAR’s scope and content, with a particular emphasis on its treatment of asset-referenced tokens (ARTs) and e-money tokens (EMTs), often referred to as stablecoins. Professor Lehmann also examined the regulation’s coverage of crypto-asset service providers (CASPs) and critically analysed its location requirements, which mandate that CASPs have a registered office and effective management within the EU. He argued that increasing use of location requirements, the lack of foreseen equivalence principle coupled with the narrow interpretation of the reverse solicitation exemption, reflect a broader trend of isolationism within EU financial regulation, potentially hindering innovation and fragmenting the borderless global crypto-asset market. The imposition of the “physical location requirement in the EU […] fragments the market and goes against the spirit of the whole market”.

Matthias Lehmann

Source:FIND / Marco Leisi

Financial Services – Status and Prospectus under WTO law

Juan Marchetti, Counsellor at the Trade in Services and Investment Division of the World Trade Organization (WTO),1 provided a crucial global perspective by outlining the status and prospects of financial services under WTO law. He began by introducing the General Agreement on Trade in Services (GATS), a foundational agreement governing trade in services among WTO members. Marchetti detailed the structure of the GATS, including its main articles, annexes (with a specific annex on financial services), and members’ schedules of specific commitments and lists of Most-Favoured-Nation Treatment (MFN) exemptions. He emphasized that the GATS is not a monolithic entity, but rather a framework that allows for variations in commitments and obligations among individual members. Marchetti then explained the four “modes” of delivery by which services can be traded between states under GATS.

He clarified that GATS covers virtually all financial services, encompassing a wide range of activities with a financial nature. Indeed, financial services are defined very broadly as “any service of a financial nature offered by a financial service supplier of a member”. Responding to a question from the audience whether crypto-asset services would qualify as financial services under GATS, Marchetti replied that crypto is primarily an asset but that many services relating to crypto assets are “financial in nature” and therefore covered. A core element of Marchetti’s presentation was an explanation of how the GATS works, focusing on the different types of obligations it imposes on member countries. He distinguished between:

General (‘unconditional’) Obligations which apply to all services, regardless of the existence of “specific commitments”. These include the Most-Favoured-Nation Treatment (MFN, Art. II GATS) and transparency obligations (Art. III GATS). Departures from MFN are only allowed in two circumstances: through an MFN exemption (which can no longer be filed), and through Economic Integration Agreements (Art. V GATS).

Commitments are made in relation to each mode of supply, and members are bound to grant market access and provide national treatment in relation to trade in services only to the extent allowed by their specific commitments. Various WTO members, including Switzerland, the United States and 17 of the EU member states have made their commitments based on a liberalization template contained in the Understanding on Commitments in Financial Services (the “Understanding”).

In addition, General (‘conditional’) Obligations (e.g., on payments and transfers, Art. XI GATS) apply to services where specific commitments have been made.

Marchetti addressed the crucial interplay between the GATS and national regulation, acknowledging the right of member countries to regulate financial services for prudential reasons, such as consumer protection and market stability. However, he also explained how the GATS seeks to address unnecessary barriers to trade in services arising from domestic regulation, through mechanisms like multilateral disciplines and additional commitments. His presentation then shifted to the specifics of GATS commitments on financial services, highlighting the outcomes of the Uruguay Round negotiations ending in 1997 and the subsequent efforts to further liberalise market access. Marchetti noted that while some progress has been made, particularly in the area of services domestic regulation, market access negotiations have largely remained inconclusive.

Marchetti's views are personal. They do not necessarily reflect the positions of WTO Members and are without prejudice to their rights and obligations under the WTO agreements.

Juan Marchetti

Source:FIND / Marco Leisi

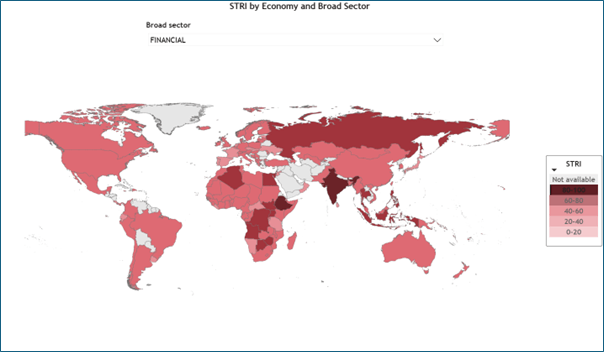

Marchetti concluded this section by presenting an overview of the current state of financial services policies globally, using the World Bank-WTO’s Services Trade Restrictiveness Index (STRI) to illustrate the persistence of significant policy restrictiveness despite decades of liberalisation. He emphasised the considerable variation in restrictiveness across different regions and sectors and stated that “barriers to trade in services are higher than for trade in goods” and highlighted “higher policy restrictiveness towards crossborder supply by foreign service suppliers” in respect to financial services policies. He visualised the level of restrictiveness in relation to financial services (the case of commercial banking) in the following graph, sourced from the World Bank - WTO STRI dashboard:

STRI by Economy and Broader Sector (FINANCIAL)

Source:World Bank - WTO STRI dashboard

He also showed that actual policies are often more restrictive than the GATS commitments. Furthermore, Marchetti elaborated on the objectives and role of GATS, thereby stressing its aim to improve international market access, to enhance policy transparency, and to provide predictability and certainty for businesses and markets. He argued that multilateral rules like the GATS are essential for ensuring global market integration, preventing fragmentation, promoting trade creation, and avoiding the marginalization of countries from global trade. Finally, Marchetti offered a glimpse into the future prospects for the WTO, highlighting its role not only as a forum for negotiations but also as a platform for discussion, cooperation, and experience-sharing among members. He raised the critical question of “how can members reinvigorate negotiations?” and adapt the GATS framework to the evolving realities of the global financial landscape.

Ray of Hope – The Berne Financial Services Agreement (UK-CH)

Stephanie Lorenz, Head Policy Issues and International Relations, Swiss State Secretariat for International Finance (SIF), provided a detailed presentation on the Berne Financial Services Agreement (BFSA) between the United Kingdom and Switzerland. The BFSA has already been approved by the UK Parliament and on 21 March 2025 by the Swiss Parliament. It is expected to enter into force in early 2026. She introduced the agreement as a significant development in a context where borders are increasingly being closed or questioned, emphasizing its timely nature and unique character. Lorenz highlighted that the agreement was the result of three years of negotiations, underscoring its complexity and the commitment of both nations. She quoted Karin Keller-Sutter, Federal Councillor, with “This agreement helps to retain and boost the international competitiveness of the Swiss financial centre in the long term.”

Stephanie Lorenz

Source:FIND / Marco Leisi

Lorenz then walked the audience through the history of the agreement, starting with the Brexit referendum and the subsequent need to address the resulting gap in financial services relations. She explained the “Mind the Gap” strategy, which aimed to maintain continuity as much as possible, and the evolution to the “Mind the Gap+” approach, involving active engagement and dialogue between Switzerland and the UK. Lorenz detailed the joint statement of intent in 2020 and the overall journey leading to the final agreement in 2023.

The presentation then focused on the core elements of the Berne Agreement. Lorenz emphasised its nature as an international treaty designed to provide market access based on mutual recognition of regulatory frameworks. She clarified that the agreement facilitates crossborder financial services to institutional, professional, and high-net-worth individual (HNWI) clients, while simultaneously ensuring market stability, integrity, and consumer protection, explicitly ruling out deregulation. Lorenz also offered insights into the negotiation process itself, acknowledging the challenges of creating a new framework from scratch, particularly concerning supervisory cooperation and the need for trust between regulatory authorities.

Lorenz highlighted "recognition" as the cornerstone of the agreement, emphasizing the importance of trust and enhanced cooperation between the two countries. She detailed the mechanisms for supervisory and regulatory cooperation, ensuring that both parties retain the freedom to regulate while establishing clear information duties and dispute settlement procedures. Lorenz also explained the prudential safeguard clause, allowing for temporary measures in cases of necessity, and the role of sectoral annexes in providing technical details for specific areas of financial services. A key aspect of Lorenz's presentation was the explanation of how market access is achieved under the agreement. She introduced the concept of "deference," where one party relies on the regulatory framework of the other party.

Lorenz provided specific examples, such as Swiss investment service providers offering services in the UK, to illustrate how provisions are "switched off" and how supervisory cooperation ensures compliance. Lorenz then outlined the specific sectors covered by the agreement, distinguishing between those with deference (investment services, insurance, financial market infrastructure for central counterparties) and those without deference where market access is based on domestic law (financial market infrastructure for trading venues and OTC derivatives, banking, asset management). She explained the rationale behind this distinction, emphasising the desire to maintain existing frameworks, for example in areas like portfolio management where substance requirements are crucial. Lorenz also mentioned future areas of cooperation, such as sustainable and digital finance. Finally, Lorenz addressed the timeline for the agreement's implementation, outlining the parliamentary approval process in Switzerland and the legislative steps in the UK, with an anticipated entry into force in 2026.

She concluded by highlighting four key success factors of the agreement: “Brexit offered a window of opportunity to negotiate this agreement and the political will on both sides was strong. The interests of both parties were balanced and compatible. The two countries have a long history of partnership and cooperation also in the financial sector which helped to establish the mutual understanding and trust that is needed to cooperate on the basis of recognition. And lastly, the agreement does not lead to changes in Swiss regulation as it would be in the case of harmonization.”

Call to Action

Chris Skinner, Author; Co-Founder The Portrait Foundation; Chair European Networking Forum Nordic Future Innovation; Non-Executive Director of 11:FS; delivered a compelling "Call to Action," urging a critical reassessment of the prevailing trends in crossborder financial services regulation. Skinner began by drawing a historical parallel between the EU's past efforts to integrate businesses and the current trend towards erecting regulatory "walls" that hinder crossborder activity. He questioned the authority and accountability of regulators, particularly in the context of emerging technologies like crypto assets, where trust is often placed in decentralized networks rather than centralized institutions. Skinner then presented a thought-provoking analysis of the contrasting approaches to innovation and regulation adopted by different regions of the world. He characterised America as a hub of innovation, China as a fast follower and imitator, and Europe as a region primarily focused on regulation.

He argued that this misalignment in regulatory and supervisory levels creates opportunities for regulatory arbitrage, where financial institutions exploit differences in rules to their advantage. Skinner said that in his view successful economies have historically thrived by maintaining open markets for both trade and finance. He emphasised the benefits of foreign financial products and services, including increased competition, spurring innovation, expanding investor choice, and contributing to financial stability through diversification. Furthermore, Skinner cautioned against the unintended consequences of closing markets, asserting that it does not strengthen the hand of EU supervisors but rather pushes financial activity to less regulated jurisdictions, thereby increasing systemic risk and making potential crises more difficult to contain. Skinner concluded his "Call to Action" with three concrete proposals based on collaborative brainstorming:

We must insist on a clear justification for restrictions to crossborder financial services and be much more rigorous in challenging these justifications.

A more rigorous intellectual framework is needed based on the proportionality principle.

Swiss authorities need to have an open dialogue about how appropriate this open border policy is now.

Chris Skinner

Source:FIND / Marco Leisi

Panel Discussion

The conference included a panel discussion moderated by Eva Selamlar-Leuthold, Head of Swiss Financial Innovation Desk (FIND); Federal Department of Finance, featuring the speakers Rolf Sethe, Matthias Lehmann, Juan Marchetti, Stephanie Lorenz, Chris Skinner as well as Dr. Hans Kuhn, Partner at Lawside Rechtsanwälte GmbH.

The panellists emphasised the fact that free trade, including free trade in services, enhances welfare because it fosters competition and therefore innovation, and it is also favourable to consumers who get access to better products at lower prices. There may be valid policy reasons for restrictions of free trade, but restrictions are always reducing overall welfare and are coming with a price tag that is measured in percentage points of GDP. There are no reasons to assume that this foundational premise would not apply to financial services, on the contrary: since an efficient financial system plays a key role for the economy as a whole and the high entry-barriers resulting from financial market regulations pose limitations to competition and innovation, benefits of open borders for financial services might be even larger than for other types of services.

Eva Selamlar-Leuthold

Source:FIND / Marco Leisi

The panellists concluded that free trade in services must not undermine the policy objectives underpinning financial market regulation: protecting clients and investors and safeguarding the integrity of financial markets and the stability of the financial system. As explained by Marchetti, the GATS and the Annex on Financial Services are accommodating these policy objectives. However, the justification for certain restrictions is not always evident, and sometimes rather flimsy. For example, the purpose to protect retail investors is obviously not suitable to justify restrictions for the provision of services to professional or institutional. The panellists argued that academics as well as industry representatives should challenge much more forcefully justifications brought forward for restrictions. The panellists agreed that financial stability is best served by a competitive and innovative financial system. Finally, the crucial role of the proportionality principle was highlighted in order to determine whether restrictions to trade in financial services are really appropriate. This also means that Switzerland – which has historically been very open to crossborder financial services – is on the right track and should by no means react to increased restrictions by other economies with building-up new obstacles.

The overall conclusion was that the current attacks on the multilateral trading systems and the trend to ever more restrictions does not mean that this is the end, as the seminar’s title suggested. The economic rationale for free trade, including free trade in financial services, is so strong that reason should prevail over time. The fact that this seminar tried to take stock of the current state of affairs and highlighted countervailing trends was already a first step in the right direction.

The panel was closed with key takeaways from each panellist:

Chris Skinner: “Build bridges, not walls” attributing this quote to Pope Francis

Stephanie Lorenz: “Rome wasn’t built in a day”

Juan Marchetti: “Don’t be afraid” referring to Pope John Paul II

Matthias Lehmann: “You should not try to build stability on boring, isolated markets”

Hans Kuhn: “Let’s stay calm and carry on”.

Rolf Sethe: “Tariffs and barriers stop competing, stop making the innovative management and technological changes we need to succeed in the world market” referring to Ronald Reagan

Rolf Sethe, Hans Kuhn

Source:FIND / Marco Leisi

Closing Remarks

Professor Rolf Sethe concluded the conference by thanking the speakers, panellists, and the audience (approximately 150 participants; both in-person and online).