The rapid advancements in artificial intelligence (AI), particularly in natural language processing (NLP) and generative AI (GenAI), are reshaping industries globally. Recent insights obtained at the Swiss NLP Expo 2025 from leaders in technology, healthcare, legal, fashion and logistics reveal a shared understanding: AI's transformative power extends far beyond mere automation, demanding strategic integration and fostering a culture of innovation. Inspired by the NLP market trends and particularly the conference’s industry talks, FIND decided to explore how diverse sectors are leveraging cutting-edge AI applications to enhance efficiency, drive innovation and redefine operational paradigms, offering valuable insights also for the financial industry navigating its own digital transformation.

Cross-Sector Insights from Technology, Healthcare, Legal, Fashion and Logistics

The industry talks at the Swiss NLP Expo 2025 offered a deep dive into the latest advancements and practical applications of NLP and GenAI across different sectors. This section offers a blend from the industry talks insights as well as from desk research. Based on both, implications were derived for the financial sector and exemplified through fictional use cases for finance to illustrate potential fields of application. Unlike other sectors subject to general data protection and other regulations, the financial sector faces a uniquely stringent and multifaceted regulatory environment due to its systemic importance.

Retrieval-Augmented Generation Systems

The technology presentation by Max Buckley, Google focused on retrieval-augmented generation (RAG) systems, a crucial architecture in modern NLP first introduced in a research paper in 2020. The paper outlined that large pre-trained language models, despite storing factual knowledge, struggle with precise access and updating for knowledge-intensive tasks, hindering performance and transparency. To overcome this, the researchers developed RAG models, which combine a pre-trained generator with a Wikipedia knowledge base and neural retriever, leading to improved factual, specific, and diverse language generation, and achieving state-of-the-art results on open-domain question answering. RAG systems have in the meantime emerged as key applications of GenAI. By combining knowledge bases with the capabilities of large language models (LLMs), RAG systems enable organizations to efficiently query and analyse their proprietary information through natural language. Indeed, according to Precedence Research, the global RAG market size is calculated at USD 1.85 billion in 2025 and is forecasted to reach around USD 67.42 billion by 2034. Other sources such as Market.us Scoop estimate an even higher market potential of USD 74.5 billion by 2034.

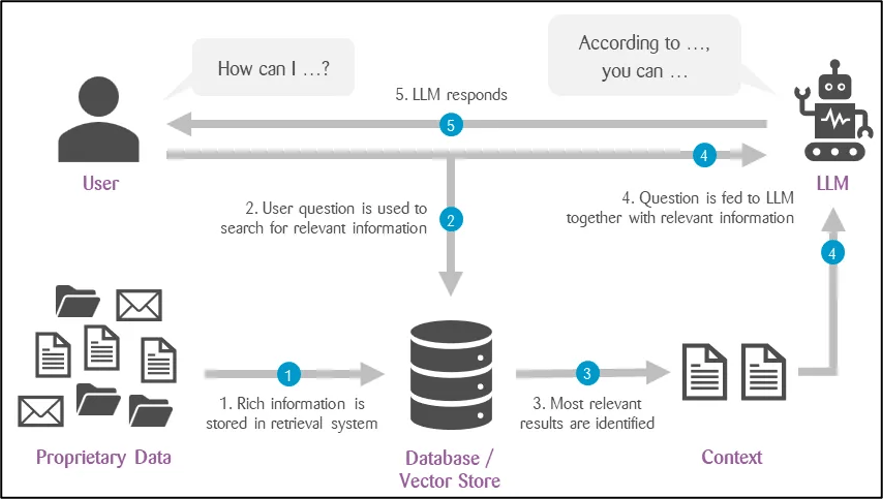

As already outlined RAG combines a pre-trained LLM with a retrieval component accessing external knowledge bases. RAG involves two phases: ingestion and retrieval. McKinsey & Company used the analogy of a large library with millions of books to illustrate the concept. In the initial ingestion phase, an index of the books‘ content would be created to allow a librarian to locate any book. As part of this process, a set of dense vector representations – numerical representation of data, known as “embeddings”, is generated for each book, chapter, or even selected paragraphs. Once the library is indexed, the retrieval phase begins. To answer a specific question, the librarian may use the index to locate the most relevant books. The selected books are then scanned for relevant content, which is extracted and synthesized into a concise and accurate output to that question. In more technical terms, databases are processed through so-called chunking, where texts are split into smaller parts (chunks) and then stored in a vector database. The most relevant results are identified and the context provided into an LLM which responses to the question.

Figure 1: Retrieval Augmented Generation (RAG) diagram

Source:Zühlke Group

RAG brings several benefits to LLMs. It improves the accuracy and factual correctness of the response, reduces hallucinations and keeps information current without fine-tuning and retraining the model. Furthermore, it provides context for the outputs for the LLM and improves transparency and trust by enabling source citation. In addition, RAG generates highly specific outputs by accessing a company’s internal sources and query external sources in real time that would be impossible for traditional LLMs to produce on their own. Difficulties and limitations include data issues like missing, incomplete, outdated and contradictory information, as well as data processing issues such as chunking-related problems. Retrieval issues also pose a challenge, as relevant information may not be retrieved or is poorly ranked. Additionally, generation problems arise when the model fails to produce satisfactory outputs even with the correct context. Apart from data quality issues, there might further be an output bias if the underlying data contains biases. Furthermore, data access and licensing concerns (intellectual property, privacy and security) need to be considered throughout the design of a RAG system.

RAG has far-reaching applications in various domains, of course also in the financial sector. By integrating RAG into existing systems, businesses can generate outputs that are more accurate than with traditional LLMs, which may improve customer satisfaction, reduce costs and enhance overall performance. This may include applications such as enterprise knowledge management chatbots, customer service chatbots, drafting assistants and enhanced data analysis. Fictional Case Studies for Finance:

Investment Research and Analysis

Scenario: An analyst needs to research a specific company’s financial performance, industry trends and competitive landscape.

RAG Implementation: A RAG system can be fed with internal company reports, SEC filings, analyst reports, news articles and market data. When the analyst asks, "Summarize the key risks for company X in the automotive sector," the RAG system retrieves relevant sections those sources, synthesizes the information, and presents a concise summary with citations back to the original documents. This allows the analyst to grasp critical information without manually sifting through numerous documents.

Customer Support for Banking Services

Scenario: A bank customer asks, "What are the eligibility criteria for a personal loan and what documents do I need?"

RAG Implementation: A RAG-powered chatbot can access the bank's specific product policies, FAQs, and internal (non-restricted) procedural documents. It can then provide precise, personalized answers based on the bank's current offerings and the customer's account type, rather than generic information.

Mergers and Acquisitions (M&A) Due Diligence

Scenario: A due diligence team needs to review thousands of contracts, financial statements, and legal documents from a target company.

RAG Implementation: A RAG system can ingest all these documents. The team can then ask specific questions like, "Are there any material adverse change clauses in contracts over $5 million?" or "Summarize all outstanding litigation." The RAG system rapidly sifts through the data, identifies relevant clauses, and provides summaries, significantly accelerating the due diligence process.

Strategic Integration of Artificial Intelligence in Healthcare

The healthcare presentation held by Elif Ozkirimli, Roche explored the strategic integration of AI in healthcare. The World Economic Forum (WEF) whitepaper “the future of AI-enabled health: Leading the way” identified three major challenges that hinder the scaling of AI in healthcare. One was the misalignment of technical choices with strategic visions highlighting that health leaders often delegate technical decisions and miss opportunities to align technology with their strategic goals. The WEF further projected that GenAI is growing faster in healthcare than in any other industry based on an estimated compound annual growth rate (CAGR) of 85% between 2022-2025. For the public sector the projected CAGR was 52%, for finance 75%. Despite the transformative nature, the potential of AI in healthcare has not yet been fully realized. The adoption at scale has been below global average, compared to other industries in 2024. This underlines the relevance of a strategic integration of AI in healthcare.

The strategic integration of AI in healthcare remains a major challenge. Historically, health systems have evolved through series of independent processes without a real overarching strategic perspective. This has led to disjoint infrastructure with ad hoc development. To move beyond this, a clear, long-term architectural vision is essential. The Pharma AI Readiness Index by CB Insights (2023) assessed the 50 largest pharma companies in Americas and Europe, based on their demonstrated ability to adopt and respond to rapidly evolving AI technologies across three key pillars: talent, execution and innovation. Roche leads this Index primarily due to their lead in AI innovation via acquisitions, investments, and patents. Roche made investments in AI talent and executed AI initiatives. Ozkirimli emphasized for Roche that of having the right model, process, people, and data is essential. The value generation journey includes business needs identification, use case selection, solution design, solution development, operations and maintenance, and change management, with a strong focus on responsible AI best practices, including security, compliance, legal and ethical considerations. Roche presented their Global GenAI and LLM strategy called GALILEO in 2023. It represents Roche’s strategic program on AI and commitment to leveraging cutting-edge AI technologies to advance its work in healthcare and diagnostics.

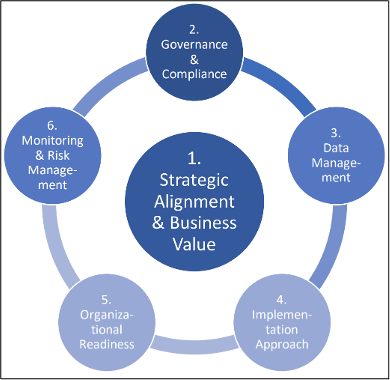

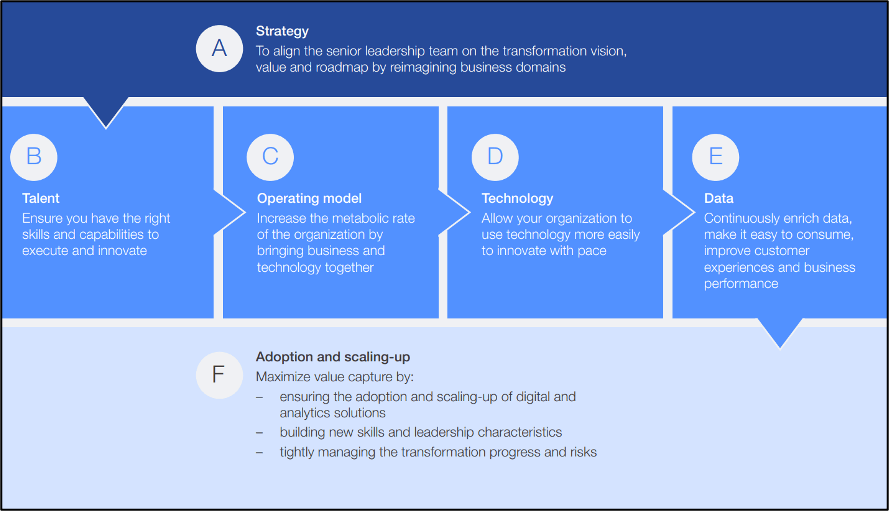

The strategic integration of AI in healthcare exemplifies both transformative potential and shared challenges for the financial sector. Swiss financial institutions operate in a highly regulated and data-sensitive environment and are therefore uniquely positioned to benefit from AI. However, the strategic integration requires a tailored approach to ensure alignment with organizational goals, regulatory requirements and operational realities according to the 2025 whitepaper by SFTI and OST. They recently developed a framework for implementing AI in Swiss Financial institutions designed to address the regulatory, organizational and technological context of the Swiss financial industry. Below each strategic dimension is briefly summarized and their components outlined. FIND further developed fictional use cases for each strategic dimension to make it more tangible.

Figure 2: Framework for Implementing AI in Swiss Financial Institutions

Source:SFTI/OST

1. Strategic Alignment & Business Value

Summary: Strategic Alignment & Business Value are cornerstones of a successful AI implementation and ensure that AI initiatives align with organizational objectives, deliver measurable business value and address key challenges such as regulatory compliance and resource allocation.

Components: Innovation Screening, Proof-of Concept Validation, Alignment with Business Objectives, Stakeholder Engagement, Regulatory and Ethical Considerations, Incremental Adoption.

Use Case “Fraud Detection”: A Swiss insurer aims to reduce financial losses through AI-driven fraud detection. They will screen for high-value use cases and validate feasibility with a proof-of-concept on transaction data to ensure ROI and alignment with risk management goals.

2. Governance & Compliance

Summary: Governance and Compliance are critical elements of the framework for implementing AI in Swiss financial institutions and ensure adherence to legal, ethical, and regulatory requirements while addressing risks associated with data privacy, security, and transparency.

Components: Regulatory Adherence, Ethical Standards, Explainability and Transparency, Data Privacy and Security, Risk Management.

Use Case “Automated AML Transaction Monitoring”: A FINMA licenced investment firm will use AI for automated AML transaction monitoring to comply with regulations. This requires establishing ethical guidelines to prevent biases, ensuring explainability of AI decisions for regulators, and implementing robust data privacy and security in line with the Federal Act on Data Protection (FADP) and sector-specific FINMA Guidance 08/2024.

3. Data Management

Summary: Data management is a foundational element for implementing AI in Swiss financial institutions as high-quality data is essential for training reliable AI models, ensuring compliance with regulatory requirements, and generating actionable insights.

Components: Data Quality and Availability, RAG, Privacy and Security, Data Governance Frameworks, Mitigating Hallucination Risks, Tokenization Strategies.

Use Case “Enhanced Customer Onboarding”: To streamline customer onboarding and enhance user experience for prospects, a Swiss FinTech will use AI for automated document analysis. This necessitates high-quality data through cleaning and preprocessing, potentially utilizing RAG for verification, and robust data governance for sensitive customer information.

4. Implementation Approach

Summary: The Implementation approach is a foundational element for implementing AI in Swiss financial institutions and provides a structured pathway for integrating AI systems into existing processes while addressing risks, ensuring compliance, and maximizing business value.

Components: Phased Implementation Model, Agile Methodologies, Integration with Legacy Systems, Compliance Checks, Iterative Testing.

Use Case “AI-Powered Customer Service Chatbot”: A Swiss pension fund will implement an AI chatbot for customer service to improve experience and reduce costs. This involves a phased approach: discovery of past inquiries, defining objectives, agile development and iterative testing, incremental deployment, and continuous optimization based internal and external on feedback.

5. Organizational Readiness

Summary: Operational Readiness is a foundational element for implementing AI in Swiss financial institutions that addresses the cultural, structural, and skill-related factors that determine an institution's ability to adopt and scale AI technologies effectively.

Components: Change Management, Upskilling and Reskilling, Leadership Buy-In, Fostering a Culture of Innovation, Addressing Cultural Resistance.

Use Case “AI-Assisted Credit Scoring”: A lending institution will introduce an AI system for credit scoring. Successful adoption requires change management through proactive communication about AI's benefits, upskilling credit analysts in data literacy, and strong leadership support to foster an innovative culture.

6. Monitoring & Risk Management

Summary: Monitoring and Risk Management are foundational elements for implementing AI in Swiss financial institutions that ensure that AI systems perform reliably, remain compliant with regulatory standards, and mitigate risks such as model drift, hallucinations, and cybersecurity threats.

Components: Continuous Monitoring, Bias Detection and Mitigation, Hallucination Risk Management, Cybersecurity Measures, Feedback Loop Management, Model Drift Prevention.

Use Case “Algorithmic Trading AI”: A wealth management firm using AI for algorithmic trading requires continuous monitoring and risk management. This includes tracking performance metrics with automated alerts for deviations, bias detection and mitigation, robust cybersecurity, and human-in-the-loop systems for high-stakes decisions and to manage potential issues like model drift.

GenAI for Legal Professionals

The legal presentation by Daniel Masato, Thomson Reuters focused on the application of GenAI for legal and other service professionals. Thomson Reuters conducted a survey with over 1700 respondents from legal; tax, accounting and audit; corporate risk and fraud; and government professionals in 2025 and found that a large proportion of respondents (41%) personally use publicly available tools such as ChatGPT and 17% use industry-specific GenAI tools. A majority of 95% believe that AI will be central to their organization’s workflow within the next five years. More than half categorize their sentiment towards GenAI in their profession as excited or hopeful. Even though usage increased, few are yet realizing the business impact of GenAI with only one fifth said their organizations were measuring ROI of GenAI. Finally, more than half of the respondents said they believe their organizations had no policies around GenAI at work and nearly two-thirds have never received a GenAI training at work.

Respondents with a positive/excited sentiment selected the following top 5 reasons why they view GenAI’s impact positively:

Will assist in saving time/streamline work processes

Expect increased productivity/efficiency

Will bring new opportunities/innovation/ growth

Will provide useful tools and solutions

Can be transformative for our industry/work in general

Respondents with a negative sentiment selected the following top 5 reasons why they view GenAI’s impact negatively:

1. Concerned with its accuracy/misinformation

2. Fear of unknown/uncertain of trajectory of AI

3. Concerns with over-reliance on AI within the industry

4. Sceptical it can deliver promised results/have experienced past failures

5. Needs careful monitoring and oversight

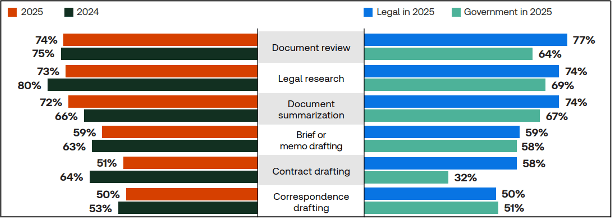

There was an overwhelming sense that its use in professional services will be inevitable. 28% law firms are already using, 14% are planning to use, 36% are considering and 22% have no plans to use GenAI. 23% corporate legal services are already using, 16% are planning to use, 32% are considering and 29% have no plans to use GenAI. There are indeed plenty of use cases for legal professionals and those are essential to legal practice. Figure 3 visualize GenAI use cases that 50% or more legal users surveyed cited.

Figure 3: Top legal and government GenAI use cases

Source:Thomson Reuters 2025

GenAI is revolutionizing the legal field by offering powerful tools for various tasks. For document review, these AI tools can quickly and accurately go through vast amounts of legal information, allowing professionals to trust the outputs. When it comes to document summarization, GenAI can rapidly and reliably summarize legal documents and pinpoint information relevant to specific cases or research inquiries. In legal research, GenAI tools efficiently and accurately conduct research by analysing immense quantities of legal documents and data, even providing citations for their findings. For brief or memo drafting, AI-powered legal drafting tools accelerate the creation of accurate documents by centralizing legal information, suggested language, clauses and editing tools. Beyond internal documents, GenAI also streamlines contract drafting, automating the complex process of searching, cutting, pasting, and editing to make drafting and analysis much faster. Finally, for correspondence drafting, a legally trained GenAI tool leverages precedents and current case law to help professionals craft correspondence with judicially tested language, reducing misunderstanding and ensuring proper formatting and grammar.

Legal professionals, whether active in law firms or corporate legal, have come to understand GenAI and progressively form a positive sentiment towards GenAI. “GenAI is here, and now the question becomes how to capitalize on it.” Many organizations need to take the next step to make it useful. Legal professionals may apply publicly available tools such as ChatGPT or use industry-specific tools such as the Thomson Reuters Practical Law Web Search platform as presented by Masato. It is an online legal know-how service to provide legal professionals with practical guidance, resources and tools to work more efficiently and advise with confidence. The platform goes beyond traditional legal research by offering a comprehensive collection of resources created and maintained by a large team of experienced attorney-editors.

GenAI is poised to significantly impact legal professionals within financial institutions as well as their collaboration with law firms. The Thomson Reuters survey highlights a strong awareness and burgeoning adoption of GenAI among legal professionals, with a substantial belief that it will be central to workflows in the near future. This sentiment may extend directly to legal professionals working in the complex and heavily regulated financial sector.

Opportunities

Legal professionals in financial institutions may utilize GenAI to increase efficiency in due diligence compliance such as enhanced document review and summarization for regulatory filings or compliance checks. It may enhance risk management such as analyzing contracts, financial disclosures or regulatory updates to mitigate legal or reputational risk. GenAI may further improve legal research and advisory by scanning through status, regulations and financial markets directives to provide precise and timely legal advice on complex financial products or transactions. This may reduce costs for financial institutions but also by automating high-volume tasks, potentially relocating time spent by junior legal teams or reducing the need for external law. By offloading repetitive tasks, legal professionals may consequently dedicate more time to high-value strategic legal work.

Challenges and Considerations

Legal professionals in financial institutions must be aware of challenges and considerations when applying GenAI. One is the hallucination risk potentially generating incorrect or misleading information. Another is confidentiality and data security as financial institutions handle highly sensitive and confidential data, especially while using publicly available GenAI tools. Regulators are increasingly focused on the use of AI in the financial sector requiring legal professionals in financial institutions to navigate through evolving cross-jurisdictional guidelines. There are further ethical considerations particularly regarding bias in algorithms with potential discriminatory outcomes posing among other reputational risks. The survey also highlighted the lack of GenAI training and organizational policies. Legal professionals in financial institutions should develop clear, comprehensive internal policies to govern the applications, train themselves and provide training to employees. The financial institutions must in any event extend their first-, second-, and third-line-of-defense procedures accordingly. Finally, striking the right balance between AI assistance and human oversight will be key.

GenAI and Fashion

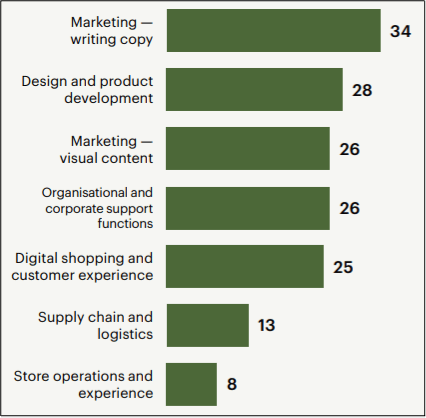

The fashion presentation by Lokesh Mishra, Zalando focused on the integration of GenAI in the fashion industry. There are multiple use cases of GenAI emerging across creative industries, including fashion. Capturing the value of the transformative technology will require fashion players to look beyond automation and explore the potential to augment the work of human creatives. Business of Fashion & McKinsey found in their State of Fashion 2024 Executive Survey that more than half of fashion executives say their companies are using GenAI. They concluded that GenAI has the potential to augment, accelerate and automate fashion business capabilities from supporting design to empowering sales teams. GenAI can create value across the fashion value chain through product development and innovation, marketing, sales and customer experience, logistics and organisation and support function. Marketing plays a key role according to the executive responses. GenAI can hyper-personalize offers, accelerate marketing content creating and enrich social media data channels by using sentiment analysis and consumer data to pivot content and messaging. Product development and innovation are also key priorities. GenAI can be used to write briefs for product collections using analytics, generate mood boards and visual imagery based on briefs and brand DNA, and convert sketches into 3D product designs and tech packs for production. Sales and customer experience also play a vital role. Use cases include enhancing digital experiences (like virtual clothing try-ons and displaying products on AI-generated models), enhancing customer service through advanced virtual assistants, tailoring product return offerings, and identifying products for exchange. Finally, organization and support functions are considered crucial. This category includes creating individualized training materials for different roles, automating support tasks (such as HR and accounting report generation or legal drafting), and improving talent acquisition by streamlining candidate sourcing through advanced algorithms. GenAI plays a minor role in the logistics of the fashion industry but hast the potential to optimize stores or augment demand forecasting.

Figure 4: Adoption of GenAI in the workplace, use cases % of respondents

Source:McKinsey State of Fashion 2024 Executive Survey

Zalando as a European fashion platform with 52 million active consumers actively integrates GenAI. One use case presented by Mishra is Zalando CLIP (Contrastive Language-Image Pre-Training) a model to learn from image and text data to retrieve images from text, overcoming limitations of keyword-based searches. The development of the model was an iterative process through several attempts, highlighting learnings from each iteration. Another use case is Zalando Assistant, an AI system that enables natural language conversations to explore Zalando's offerings, understand fashion trends and plan outfits. Additional applications like body measure (creating avatars and body scans from photos) and inspiration and entertainment (integrating influencer content and TikTok-like features) are also applied.

The integration of GenAI in fashion might appear disparate but offers a fascinating parallel to the financial sector. Both industries are driven by data, customer preferences, market trends and the need for efficient operations. Financial institutions can draw significant inspiration from how fashion companies are leveraging GenAI, particularly in areas like personalized customer engagement, data-driven insights, and streamlining internal processes. Financial institutions, despite their traditional image, are increasingly focusing on customer-centricity, innovative product development, and operational efficiency, areas where GenAI can be a powerful enabler. Fictional use cases for finance, bearing in mind that regulatory restrictions are stricter in finance than in fashion:

Hyper-Personalization of Financial Products and Services: Just as GenAI tailors fashion offers, it can create highly personalized financial product recommendations, investment strategies, and financial advice based on individual client data, risk profiles, and financial goals.

Enhanced Customer Experience in Banking: Similar to virtual try-ons and advanced virtual assistants in fashion, GenAI can power intelligent chatbots for customer service, offer interactive financial planning tools, and visualize complex financial data in an intuitive way.

Data-driven Marketing and Communication: Financial institutions can leverage GenAI to generate targeted marketing content for different client segments, craft personalized financial literacy materials and analyse sentiment from customer interactions to refine messaging and improve service.

GenAI and Logistics

The logistics presentation by Sebastian Welter, Ikea presentation investigated the transformative impact of GenAI on Ikea's logistics and supply chain (focus on internal logistics). Transportation (broader concept of moving people and goods) and freight logistics (narrow concept of moving goods) are both data-heavy operations that are well suited to take advantage of the recent technological developments in advanced analytics, notably in AI and machine learning. Some industry players are already using AI to improve efficiency, but there is a lot of potential to be captured across the sector. Indeed, the technology can enhance predictive capabilities, optimize operations and support strategic priorities. The WEF whitepaper on “Intelligent Transport, Greener Future: AI as a Catalyst to Decarbonize Global Logistics” highlights that AI has a significant decarbonization potential. The analysis suggests that three specific levers powered by AI could collectively reduce total emissions from freight logistics by 10-15%. The three levers are enhancing operational efficiencies (e.g. route optimization), improving capacity utilization (e.g. reducing empty capacity issues by matching demand/supply) and optimizing modal shifts (e.g. from road to rail). Despite focusing on decarbonizing on freight logistics, the WEF paper offers valuable insights to embrace the AI opportunity for logistics in its holistic understanding by offering three recommendations:

1. Maximizing AI Impact through Behavioral Shifts

Operational Integration and Value Demonstration: Integrate AI applications to deliver tangible benefits that demonstrate value to end-users and corporate clients. Focus on solutions that optimize processes and provide clear advantages.

User Adoption and Mindset Change: While AI can automate many improvements, maximizing its impact still requires fostering a mindset where real-time insights from AI are adopted and acted upon by personnel at all levels. This for instance includes influencing how drivers operate vehicles based on AI recommendations.

Strategic Network Rethinking: Consider leveraging AI not just for incremental operational optimization, but for fundamental redesigns of logistics networks in the long term.

2. Crucial collaboration across the Logistics Ecosystem

Vertical Collaboration for Intermodal Solutions: Promote collaboration between shippers (customers) and carriers (transport/logistics providers) to develop more efficient intermodal solutions. Strategic partnerships and data-sharing agreements can align incentives across the value chain.

Horizontal Collaboration for Shared Goals: Foster partnerships among logistics companies, even competitors, to achieve shared operational goals. This requires overcoming competitive concerns and establishing trust.

Data Sharing and Standardization: Emphasize increased data sharing and transparency among all stakeholders to enhance AI's effectiveness. Develop cross-ecosystem best practices for data management, training, and transparency, and push for standardized data formats and interoperability between systems.

Public-Private Partnership and Oversight: Engage in partnerships with governments and technology platform providers, ensuring robust oversight to mitigate any anti-competitiveness concerns arising from increased collaboration.

3. Integrating AI needs Vision from Leadership and Bottom-Up Action

Digital Maturity and Capability Building: Acknowledge the current digital maturity level of the logistics sector and invest in best practices for digitalizing operating models and utilizing AI solutions. This includes building strong technological foundations and investing in training for relevant teams (e.g., strategy and procurement).

Vision-Driven, Action-Oriented Approach: Senior leadership must set a clear vision for AI integration, complemented by a bottom-up approach that encourages experimentation and delivers tangible results at the company level.

Phased AI Adoption: Companies can progress through different AI adoption approaches: "taker" (off-the-shelf solutions), "shaper" (augmenting models with proprietary data), or "maker" (developing new foundational models).

Cost-Benefit Analysis: Recognize that AI deployment involves costs, but proactive action can lead to significant long-term benefits, including improved financial stability and competitive advantage.

Responsible AI Deployment: When considering AI solutions, evaluate the computational resources and associated energy consumption required, ensuring responsible implementation to maximize overall efficiency and benefits.

Figure 5: Strategic framework to enhance digital maturity in organizations

Source:WEF, 2025

As a global enterprise in home furnishing, logistics is incremental for Ikea. Sebastian Welter gave insights about how GenAI changes logistics and supply chains within Ikea with a focus on internal logistics. He exemplified the bottom-up action to senior leadership with Ikea’s CEO’s personal experience who got inspired by his son, applying AI for his homework, to drive AI adoption within Ikea. The convergence of physical and digital automation is fundamentally reshaping the business. This means an increasing integration and blurring of lines between the physical world (machines, sensors) and the digital world (data, software, analytics). Automated vehicles and robots in warehouse and production become more intelligent and AI based ultimately enhancing automation. Computer vision (cameras) is also more applied, driven by advancements in China and decreasing hardware costs. Welter emphasized the increasing understanding and trust in AI throughout the organization, leading to more business-driven AI initiatives as well as AI education.

Both the logistics and the financial sector, by their very nature, operate in a global, highly dynamic, complex and data-rich environment, making it a fertile ground for practical AI application. The financial industry can learn significantly from AI's implementation in logistics by focusing on tangible operational improvements with clear ROI, like cost reduction and efficiency gains. Logistics highlights the power of real-time operational data for dynamic decision-making and the necessity of holistic network optimization over siloed solutions for maximum impact. Crucially, the financial sector can observe the importance of user adoption and trust in AI, fostered through bottom-up engagement and education, ensuring human-AI collaboration. This practical approach, encompassing responsible deployment and a long-term strategic vision, offers the financial industry a blueprint for leveraging AI to achieve sustainable competitive advantage and broader value creation. Potential case studies for finance:

AI-driven credit underwriting platform

An insurance provider integrated an AI-driven credit underwriting platform that provided real-time risk assessments and loan approval recommendations, significantly speeding up their lending process and reducing defaults. By transparently showing how the AI analysed complex data, the insurance provider fostered a mindset shift among human underwriters, leading to high adoption of AI insights and enabling a strategic rethinking of their entire credit portfolio management from a reactive to a proactive, AI-informed risk mitigation approach.

Ecosystem Collaboration and AI for Trade Finance

A global Swiss bank launched the project “Collabtrade. The bank established a strategic data-sharing platform with corporate clients on trade flows and collaborated with other financial institutions and customs to verify documents. This AI-powered approach led to faster processing and substantially reduced fraud risks in the ecosystem.

AI for Fraud Detection

A global asset manager’s CEO stated that AI was crucial for fighting fraud, while also starting a "data detectives" program. This program let analysts try out and elaborate AI tools on suspicious transactions, meaning the AI system was built effectively from practical ideas and guidance from the top.

Conclusion

The rapid advancements in AI, particularly in NLP and GenAI, are profoundly reshaping diverse industries, offering crucial lessons, direct applications and use cases for the financial sector. Cross-sector insights from technology, healthcare, legal, fashion, and logistics reveal a shared understanding of AI’s and GenAI's transformative power and provide a blueprint for financial innovation. While all sectors are subject to data protection and other regulations, the financial sector face a uniquely stringent and multifaceted regulatory environment due to its systemic importance such as financial stability or consumer protection.

Technology: Retrieval-Augmented Generation Systems

From the technology sector, the emergence and relevance of RAG systems as key applications of GenAI presents a significant spill-over potential to finance. RAG systems, by combining knowledge bases with LLMs, enable efficient querying and analysis of proprietary information through natural language. Integrating RAG systems into existing systems in finance is crucial. They may generate outputs that are more accurate and even real-time which improve customer satisfaction, reduce costs and enhance overall performance. FIND recognises many potential application fields for RAG in finance such as enterprise knowledge management chatbots, customer service chatbots, drafting assistants and enhanced financial data analysis. The use cases for finance such as investment research, RAG-powered customer chatbots or M&A due diligence showcases the transformative potential of the technology for financial institutions.

Healthcare: Strategic Integration of AI

From the healthcare sector, the strategic integration of AI with a key challenge of misalignment of technical choices with strategic visions is relevant to financial institutions. The emphasis on aligning technical choices with strategic visions, as exemplified by Roche's GALILEO strategy, ensuring the right model, process, people, and data highlights challenges and practices pertinent to the financial sector. The cross-sector insights appear even more relevant as both industries operate in highly regulated and data-sensitive environments. Financial professionals should further consider the relevance of the three pillars of the Pharma AI Readiness Index: talent, execution and innovation. The valuable strategic framework by SFTI/OST for implementing AI in Swiss financial institutions, which addresses unique regulatory, organizational, and technological contexts, directly reflects these strategic considerations. The framework's dimensions: Strategic Alignment and Business Value, Governance and Compliance, Data Management, Implementation Approach, Organizational Readiness, and Monitoring and Risk Management—are all crucial for successful AI adoption in finance. The use cases for finance for each strategic dimension further highlighted the broad variety of applications in finance and ultimately the relevance of the strategic integration of AI in financial institutions.

Legal: GenAI Adoption

From the legal sector, a growing adoption of GenAI and centrality in workflows is recognized. This presents significant opportunities for legal professionals within financial institutions. Despite positive sentiment and increasing application, financial institutions must begin measuring GenAI's business impact, establish policies and provide internal training. While challenges like data security, cross-jurisdictional guidelines and ethical considerations exist, GenAI is here to stay. The focus now shifts to capitalizing on its capabilities. GenAI tools enhance efficiency in due diligence and compliance by improving document review and summarization for regulatory filings. They also strengthen risk management through analysis of contracts and regulatory updates, mitigating legal or reputational risks. Furthermore, GenAI improves legal research and advisory by sifting through regulations, offering precise and timely advice on complex financial products, potentially reducing costs. Therefore, financial institutions should consider applying publicly available or industry-specific GenAI tools for legal work (e.g., research, document review, contract drafting), measure their impact, develop clear internal policies and train employees.

Fashion: Hyper-Personalization and Marketing with GenAI

From the fashion industry, the growing integration of GenAI offers a fascinating parallel to the financial sector due to shared drivers like data, customer preferences, and market trends. Financial institutions can learn a lot from fashion companies that use GenAI to personalize customer experiences, gain insights from data, and make their operations more efficient. This translates to hyper-personalization of financial products and services, creating tailored recommendations based on individual client data and risk profiles. GenAI can also enhance customer experience in banking through intelligent chatbots for customer service and interactive financial planning tools, similar to virtual try-ons in fashion. Furthermore, data-driven marketing and communication in finance can benefit from GenAI by generating targeted content and analysing sentiment from customer interactions.

Logistics: Operational Optimization and Collaboration

From the logistics sector, experience with AI offers valuable insights for finance, as both operate in global, dynamic, complex, and data-rich environments. Lessons for finance include focusing on tangible operational improvements with clear ROI and leveraging real-time operational data for dynamic decision-making. Maximizing AI's impact hinges on behavioral shifts like user adoption, demonstrating value and operational integration, which optimize processes and networks. A crucial lesson is the need for ecosystem-wide collaboration through data sharing, standardization, partnerships with governments, tech platforms and even competitors. This allows to create more efficient and impactful solutions than isolated efforts, serving as a blueprint for finance. A key takeaway emphasizes the importance of a clear AI vision from leadership (taker, shaper, maker), complemented by a bottom-up approach that fosters company-level experimentation. Concluding, financial institutions should in FIND’s view actively engage in the ecosystem via collaboration, develop a strategic vision, optimize operational execution and focus on user adoption to achieve a competitive advantage and broader value creation.

In short, lessons from other industries show that AI has transformative power and great potential for finance if it is used in a smart and well-planned way. This means not just adopting new technology, but also robust governance, effective data management and crucially an organization ready for change. By learning how others use AI, financial institutions can innovate, work more efficient and adapt to the digital reality.

FAQ

Glossary

Anti-Money Laundering (AML)

A set of laws, regulations, and procedures designed to prevent criminals from disguising illegally obtained funds as legitimate income. AI is increasingly used to automate and enhance AML transaction monitoring.

Artificial Intelligence (AI)

The simulation of human intelligence processes by machines, especially computer systems. These processes include learning, reasoning, problem-solving, perception, and understanding language.

Bottom-Up Approach

An organizational strategy where initiatives and experimentation are driven by lower-level employees, with successful applications potentially influencing broader strategic decisions

Change Management

A structured approach for ensuring that changes (such as the adoption of new technologies or processes) are smoothly and successfully implemented within an organization, leading to lasting benefits.

Chunking

The process of splitting large texts or documents into smaller, manageable parts (chunks) to facilitate processing and storage in databases, especially for RAG systems.

Compound Annual Growth Rate (CAGR)

The average yearly rate at which something, like an investment, has grown over a specific period longer than one year, assuming the growth was steady and reinvested. It helps smooth out yearly ups and downs to show a consistent average growth rate.

Data Governance

The overall management of the availability, usability, integrity, and security of data used in an enterprise. It includes defining roles, responsibilities, and processes for data handling to ensure compliance and quality.

Data Literacy

The ability to read, work with, analyze, and communicate with data. In the context of AI, it refers to the skills needed by employees to understand AI-generated insights, interact with AI tools, and make informed decisions based on data.

Digital Maturity

The organizational capability to leverage digital technologies and strategies to adapt to new market conditions, drive innovation, and enhance performance across all business functions. It involves technological adoption, cultural shifts, and strategic alignment.

Digital Transformation

The process of adopting digital technology to fundamentally change how an organization operates and delivers value to customers. It involves integrating digital technology into all areas of a business, leading to cultural shifts and new operational paradigms.

Ecosystem Collaboration

The strategic partnership and interaction among various stakeholders (e.g., companies, governments, technology providers, even competitors) within a specific industry or domain to achieve shared goals and leverage collective resources, often for innovation or efficiency gains.

Embeddings (in AI context)

Low-dimensional vector representations of discrete data (like words or images) in a continuous space. They map similar items closer together, capturing meaningful relationships and enabling efficient processing by machine learning models.

Generative Artificial Intelligence (GenAI)

A type of artificial intelligence that can generate new and original content, such as text, images, audio, and code, based on patterns learned from existing data.

Hallucination (in AI context)

A phenomenon where an AI model, particularly an LLM, generates information that is plausible-sounding but factually incorrect, nonsensical, or not derivable from its training data or provided context.

Human-in-the-Loop Systems (in AI context)

AI systems designed to incorporate human oversight and intervention at key decision points. This ensures that humans can review, validate, and correct AI outputs, especially in high-stakes environments, combining the efficiency of AI with human judgment and ethical considerations.

Hyper-Personalization

The practice of tailoring content, products, services, and experiences to individual users in real-time, often using advanced data analytics and AI to predict and respond to individual preferences and behaviors with high precision.

Incremental Adoption

A strategy for implementing new technologies or changes in a step-by-step or phased manner, rather than a single, large-scale deployment. This allows organizations to test, learn, and adapt, minimizing disruption and risk.

Intermodal (Logistics context)

The transportation of goods using multiple modes of transport (e.g., truck, rail, ship, air) where the cargo remains in the same standardized container throughout the entire journey, without being reloaded when switching between modes.

Open-Domain Question Answering

An AI capability that allows a computer system to answer almost any question you ask in plain language, drawing its information from a vast, general knowledge source like the internet or a massive collection of documents, without being limited to a specific topic.

Large Language Models (LLMs)

Advanced deep learning models that have been trained on massive datasets of text and code, enabling them to understand, generate, and interact with human-like language for various tasks.

Legacy Systems

Older computer systems, software, or applications that are still in use because they are critical to business operations, despite being outdated, potentially inefficient, or difficult to integrate with newer technologies.

Mergers and Acquisitions (M&A)

Corporate transactions in which two companies combine to form a new single company (merger) or one company takes over another (acquisition). AI tools are used to streamline the due diligence process in M&A.

Model Drift

A phenomenon where the performance of an AI model degrades over time due to changes in the underlying data distribution, leading to less accurate predictions or outputs.

Natural Language Processing

A subfield of AI that enables computers to understand, interpret, and generate human language. It involves tasks like text analysis, machine translation, and speech recognition.

Neural Retriever

An advanced AI system that uses deep learning to understand the meaning behind a search query and then finds the most relevant information from a large collection of documents. It's designed to go beyond simple keyword matching, connecting ideas and concepts to deliver better results.

Organizational Readiness

The state of an organization's culture, structure, skills, and processes that determines its capacity to effectively adopt, integrate, and scale new technologies like AI.

Phased Implementation Model

A project management approach where a new system or solution is introduced in stages or phases, rather than all at once. This allows for gradual adoption, testing, and refinement, reducing risks and facilitating smoother transitions.

Proprietary Information

Data, knowledge, or intellectual property that is owned by an individual or organization and is kept confidential due to its competitive value. In AI, using proprietary information safely and effectively is key, especially with systems like RAG.

Retrieval-Augmented Generation (RAG):

An AI architecture that combines a large language model (LLM) with an external knowledge retrieval system. It allows the LLM to access and integrate specific, up-to-date information from a database to produce more accurate and contextually relevant responses.

Return on Investment (ROI)

A performance measure used to evaluate the efficiency or profitability of an investment or compare the efficiency of several different investments. In the context of AI, it refers to the financial benefits gained relative to the costs of implementing AI.

Sentiment Analysis

The process of using natural language processing, text analysis, computational linguistics, and biometrics to systematically identify, extract, quantify, and study affective states and subjective information. It helps determine the emotional tone behind a piece of text (e.g., positive, negative, neutral).

Tokenization

The process of breaking down a sequence of text into smaller units called tokens. These tokens can be words, subwords, or characters, and are a fundamental step in preparing text for NLP models.

Upskilling/Reskilling

Processes of training employees to acquire new skills (upskilling) or entirely different skills (reskilling) to remain competitive and adapt to evolving job requirements, particularly those brought about by technological advancements like AI.

Vector Database

A type of database designed to store, manage, and search embeddings (numerical representations of data) efficiently. It is crucial for RAG systems to quickly find relevant information based on semantic similarity.

This glossary was generated using artificial intelligence.