The Swiss financial industry is facing various challenges like increased regulatory requirements and the need for improved customer experience and personalized advice to combat margin erosion. These challenges make innovative business models like Embedded Finance, Banking-as-a-Service (BaaS) and Insurance-as-a-Service (IaaS) critical for future growth.

Embedded Finance allows non-financial companies to offer financial services seamlessly within their platforms, which enhances user experience and creates new revenue streams, particularly in areas like payments, lending, investing or insurance. Rather than going to the bank/insurer – physically or digitally – consumers and businesses want the financial service provider to come to them.

Swiss consumer interest in Embedded Finance is high, more than a stunning 75% of questioned men and women are already using Embedded Finance, see first academic study in Switzerland by Dr. Manuel Thomet, Yves Schuster and Prof. Dr. Bernhard Koye, “Embedded Finance und BaaS in der Schweiz, Outlook Studie 2024", p. 290 (available here). However, many non-financial companies are still hesitant to integrate them. The cited study detects significant growth potential for Embedded Finance business models. This led the Swiss Financial Innovation Desk (FIND) to do a Pathway 2035 for Financial Innovation deep-dive to equip you with the very essentials for the upcoming journey.

What is Embedded Finance, and why does it matter?

Consumers and businesses expect financial services to be instantly accessible when needed and invisible when not. Financial institutions, FinTechs and other players capable of integrating into our digital lives will thrive, others risk being forgotten soon.

One of these integrations into our daily lives is Embedded Finance – a new development in financial services, allowing non-financial companies to offer financial tools directly to their customers. This empowers any business with no financial license to offer personalized financial solutions to its customers by leveraging existing software, APIs, payment gateways and other infrastructure, facilitating a frictionless experience for consumers while expanding the potential services offered by such non-financial entity. This results in seamless, integrated financial experiences within everyday platforms like e-commerce or apps.

Revenues from Embedded Finance is growing at double-digit rates and could surpass €100 billion in Europe by the end of the decade, according to a McKinsey forecast (see Embedded finance in Europe: Converging platforms | McKinsey McKinsey forecasts).

Is Embedded Finance the same as Banking-as-a-Service (Baas) or Insurance-as-a-Service (Iaas)?

Almost. BaaS (which can also be called “White Label Banking”) or Iaas (“White Label Insurance”) and embedded finance share common grounds. The white labelling is a service model, where banks, insurance carriers or other financial institutions extend their infrastructure and services which they operate under a regulatory licence and prudential supervision to third-party businesses. On the other hand, Embedded Finance focuses on seamlessly integrating financial services into platforms that are not primarily associated with finance in nature (for further details see https://satchel.eu/blog/embedded-finance-all-you-need-to-know). So while BaaS or IaaS describe the extension of a service by a licensed financial institution to a third party, e.g. to a FinTech with a “lower” license which may not yet be ready for a step-up to a fully-fledged banking or insurance license, Embedded Finance puts the focus on the point of sale, which is no longer with the financial institution, but with a non-financial firm (for more information see the cited Embedded Finance study, p. 64). For this, financial and non-financial firms must work very closely together as partners to implement Embedded Finance customer journeys. Financial institutions such as banks or insurance carriers have to “get used” to their new role as BaaS/IaaS providers. They no longer occupy the interfaces to the end customer and hand over control to the embedder.

How does Embedded Finance work?

The concept of Embedded Finance involves Application Programming Interfaces (APIs) and partnerships with licensed banks or other financial providers. These connections allow companies to integrate services like payments, lending or insurance seamlessly into their existing customer journeys.

This process involves securely connecting financial institutions with businesses, enabling smooth data sharing and regulatory compliance. The use of customer data and Artificial Intelligence (AI) helps to personalise financial offerings, assess risks and streamline operations for users. See our example for how Embedded Finance works step-by-step in our FAQ.

Embedded Finance thus transforms the traditional boundaries between – as in the FAQ example – shopping and banking, creating a smoother, more integrated experience for consumers while opening new revenue streams for businesses across different sectors. In other words: “More banking, less bank. Let two customer journeys become one” (tentative translation by FIND) as Thomas Hilgendorff, Co-Founder and CCO Yapeal, a Swiss Fintech licensed under art. 1b Banking Act, has aptly put it in his foreword to the “Embedded Finance und BaaS in der Schweiz” study. A statement that in our view can be rooted back to the famous and not uncontroversial quote ascribed to Bill Gates: “Banking is needed, banks are not".

But there are – rightly so – also prominent critical voices against Embedded Finance. 90% of people live day-to-day worrying about they meet months’ end says Chris Skinner. The idea of making paying so much easier, invisible and embedded does not suit everyone. Many people prefer cash because with cash they can see what they spend - because they simply need to. He sees room for improvement and asks: “Do we enable people to care about their money? Do we provide sufficient methods and means to save, rather than spend? Do we think enough about educating people how to manage their lives with money?” He sees a huge opportunity for those willing to think about it and enable embedded and invisible finance that provides smart, educational, informed, real-time support”. AI (incl. machine learning and agentic bots) could analyze someone’s spending and alerting them when they are out of range, by either spending too much or missing savings opportunities or being able to save more or not having enough savings. Chris Skinner views this as “Intelligent Finance” or “Informed Banking”, which FIND will take up in more detail in a future deep-dive publication around international best practices on data sharing and more tailored financial services provision.

What Risks and Challenges Must be Considered when Dealing with Embedded Finance?

Embedded Finance comes with significant regulatory and compliance challenges, particularly around data privacy, anti-money laundering, and Know Your Customer requirements.

Companies must ensure they meet these standards to avoid penalties and maintain legal compliance. Data security and privacy are critical concerns, as embedded finance platforms handle sensitive customer information. Robust security measures are essential to protect against cybersecurity threats and maintain user trust in these financial services.

Additionally, there are operational risks, including API reliability and scalability, as well as dependence on third-party providers. The growing number of companies offering similar financial services also raises the risk of market saturation, potentially leading to reduced profitability for some businesses.

The Current State of Embedded Finance in Europe and Beyond

As of 2025, the market is maturing and expanding beyond payments and lending into sectors like insurance, healthcare, and logistics. European businesses are increasingly adopting embedded finance, with 96% planning to roll out embedded payments and 94% planning embedded banking. Forthcoming regulatory developments, such as the proposed financial data access (FIDA) framework and the third European Payment Services Directive, will further facilitate Embedded Finance. For example, the FIDA proposal would cover mortgages and loans, pensions, savings and non–life insurance products, and data that could underlie a creditworthiness assessment (Source McKinsey).

Looking beyond the EU, the study by IBM, in collaboration with the Banking Industry Architecture Network (BIAN) and Red Hat, titled "Embedded Finance: Creating the Everywhere, Everyday Bank" is particularly insightful. The study, released in September 2023, surveyed over 12,000 consumers across 12 countries and interviewed 1,000 industry leaders from banks with assets of more than $10 billion across 32 countries. To no surprise, the study views the economic potential as enormous. What caught FIND’s interest were the following conclusions of the IBM/BIAN/Red Hat study:

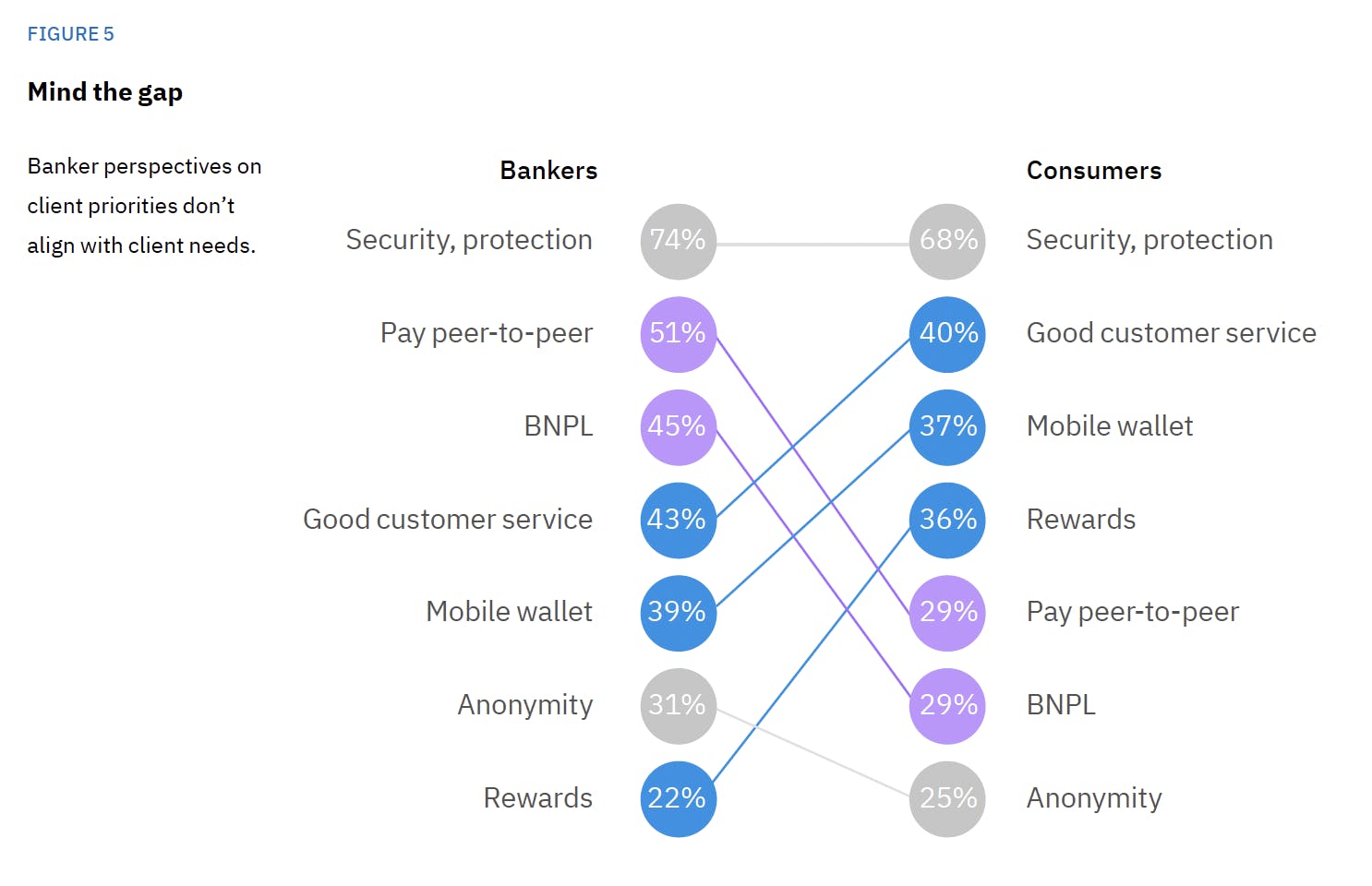

Bank executives’ priorities are not aligned with Consumer Demands: Bankers underappreciate the value of mobile wallets, personalized rewards, and satisfying customer services.

Question to consumers “Which of these payment features is the most important to you? And which is the least important?” and corresponding question to bank executives “Which of these payment features is the most important for your clients? And which is the least important?”

Source:IBM/BIAN/Red Hat

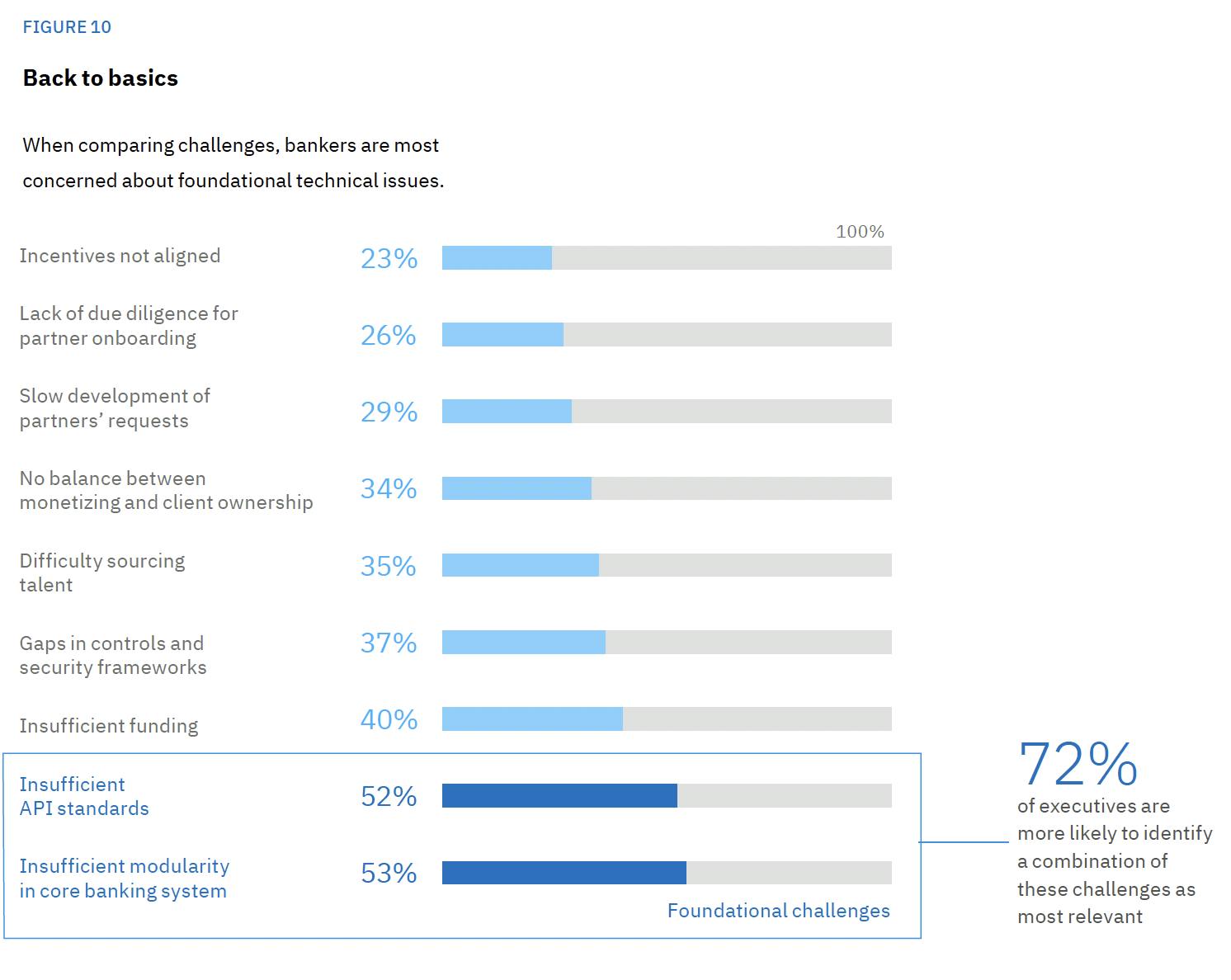

Monolithic architectures and processes hinder banking ambitions: Foundational gaps in modernization and API standardization are hampering Embedded Finance outcomes: insufficient modularity of core banking systems (53%), inadequate API standards (52%), and lack of funding commitment for long-term strategies (40%) are the top constraints holding banks back.

Question to bank executives “Which challenge has had the greatest/least adverse impact on your embedded finance journey?”

Source:IBM/BIAN/Red Hat

The Current State of Embedded Finance in Switzerland

In its Digital Finance Report from 2022, the Swiss Federal Council has defined specific measures to achieve a strong digital financial sector. These include, among other aspects, the area of ‘open finance’, which has been identified as a significant driver of innovation with standardised interfaces.

While Embedded Finance allows non-financial companies to integrate financial products and other data into their customer-facing channels, open finance can be seen as an extension of the idea of Embedded Finance. According to the Swiss industrial conglomerate openbankingproject.ch, open finance describes the exchange of any data from the financial industry. For example, securities account data, insurance data or financing information can be made accessible and useable in this context. The reality for individuals and businesses in Switzerland today is highly fragmented, FIND will soon publish more on this.

Key Findings of the First Academic Study on Embedded Finance in Switzerland

The already mentioned Embedded Finance Study by Dr. Thomet, Yves Schuster and Prof. Dr. Koye included relevant players – banks, enablers, embedders and consumers. The aim of the study is to enable Swiss banks and embedders (non-banks) to better assess the economic potential of Embedded Finance and to gain a more differentiated understanding of the conditions for the successful implementation of new business and operating models.

In Switzerland, 76.3% of consumers have used Embedded Finance services, according to the study conducted between October 2023 and April 2024. The report, based on surveys with 1026 consumers and over 70 industry stakeholders, shows a strong correlation between higher digital skills and increased use of Embedded Finance services. Key motivators for adoption include speed and efficiency (43.5%), cost savings (17.8%), and access to secure, personalised banking services.

In terms of new technologies, the key question is whether and when customers will start to use them in a way to create significant new value that either complements or even replaces the traditional ones in the medium term. In management literature, this moment is often referred to as the ‘tipping point’. Specifically, this occurs when 16% of potential users start to use a new offering. After that, a positive feedback loop creates a knock-on effect that leads other users to adopt the innovation as well.

The tipping point of user behavior has already been passed for (1) investing, (2) retirements planning and (3) payments. However only 40% of non-banking companies surveyed offered embedded banking services, with reasons for not doing so including lack of understanding (33%) and ongoing evaluations (22%), but 55.5% showed potential interest, signaling significant growth opportunities, particularly in retirement planning, financing, and payment services.

Study Authors’ Recommendations to strengthen the potential of Embedded Finance

The study demonstrates that consumers are already adopting embedded banking services that offer tangible value and reduce pain points or are prepared to alter their behavior if such services become available. One of the key findings is that consumers are eager to adopt service combinations that simplify their lives, particularly in terms of managing their financial needs, which supports Chris Skinners' call to action. There is a clear opportunity for providers to increase the use of banking services by developing solutions that meet consumer demand.

Over 50% of embedders and banks recognise the economic importance of the emerging value chains in embedded banking. However, banks perceive partnerships with modern embedders to be a more attractive proposition than those with traditional companies, given the significant changes that would be required to work with the latter. Embedders, on the other hand, view banking services as a highly attractive proposition, particularly in the payments sector, which is seen as a commodity.

As recommended actions for policymakers, the authors of the study purpose initiating cross-industry dialogue in task forces, supporting the interlinking of empirical research and practice by funding research activities, and promoting international exchange and know-how transfer.

For banks and embedders, the authors recommend both changes to the business model (review positioning, develop a roadmap for collaborations) and to the operating model (develop mindset and organisation as well as technological expertise for cooperative value creation configurations). The authors also see an important success factor in communication and cultural change at C-level and on the board of directors.

Culturally, embedders appear to be better positioned than banks to capitalise on embedded banking opportunities. However, the low response rate from embedders suggests a lack of strategic awareness. Banks, despite a higher response rate, face significant cultural and technological challenges in adapting to future business models. The analysis also highlights differences between current and potential players, indicating that both embedders and banks need to take further action to realise the full potential of embedded banking.

FIND Conclusions

The first academic study “Embedded Finance und Banking as a Service in der Schweiz” focused on embedded banking, it remains to be seen if the study’s results would equally hold true for embedded insurance in Switzerland. We wouldn’t be surprised if yes.

Given the study’s results and having conducted own qualitative interviews and research on the topic, FIND comes to the following conclusions:

Embedded finance is essential for modern banking and modern insurance strategies and should be a standing agenda item in strategic discussions at both financial and non-financial service providers.

Successfully executing Embedded Finance strategies relies on a myriad of factors. Acknowledging the value of good customer experience, the value of data, the value of new collaboration models and safe yet agile technological infrastructure counting to the most important factors in our view.

Further information:

Launch Event of the Embedded Finance / BaaS Study of 3 Oct 2024

IBM and BIAN and Red Hat study “Embedded Finance - Creating the everywhere, everyday bank”, 2023

Dr. Manuel Thomet, Yves Schuster and Prof. Dr. Bernhard Koye, “Embedded Finance und BaaS in der Schweiz, Outlook Study 2024"