Artificial Intelligence (AI) is emerging as a central force in reshaping the future of finance. In January 2025, the Swiss Financial Innovation Desk (FIND) published Pathway 2035 for Financial Innovation – Your Navigator (“Pathway 2035”), a forward-looking guide developed in collaboration with experts from government, academia and industry. Building on the foundational ideas laid out in the Bank for International Settlements’ working paper Finternet: The Financial System for the Future by Agustín Carstens and Nandan Nilekani, the publication expands the vision of a globally interconnected financial ecosystem. FIND’s Pathway 2035 identifies four major technological vectors that will drive this transformation: digital trust, digital assets, quantum-safe technologies... and AI. These technological trends capture both the disruptive potential and the systemic implications of innovation, calling for coordinated, inclusive and forward-thinking approaches to financial governance.

The chapter dedicated to AI explores how intelligent systems are transforming financial services through greater efficiency, personalization and resilience. It reflects not only in-depth research and expert consensus, but also real-time feedback from the field.

Global approaches and Switzerland’s hybrid model

At the global level, Pathway 2035 outlines three dominant approaches to AI. The United States promote a market-driven model that favours speed and entrepreneurship with limited regulatory barriers. China takes a state-coordinated route, aligning AI development with national priorities and exercising strict oversight. The European Union builds a rights-based framework, rooted in ethics, risk classification and accountability.

These differing philosophies carry real consequences, influencing how data is governed, how innovation is financed and how trust is cultivated. Pathway 2035 stresses the importance of understanding these models in depth and calls for greater international alignment to prevent regulatory fragmentation and ensure secure, interoperable systems.

Switzerland is carving out its own path. In February 2025, the Federal Council confirmed its intention to ratify the Council of Europe’s Convention on Artificial Intelligence and to integrate it into national law. The signing then took place in March 2025. Rather than applying a blanket approach, Switzerland will pursue targeted legislative amendments in key sectors such as healthcare and mobility, alongside cross-sectoral provisions on data protection, transparency and non-discrimination. This legal framework will be complemented by non-binding tools – including self-regulatory codes and industry standards – allowing for a flexible yet robust governance model.

This dual-track approach reflects Switzerland’s ambition to remain a global leader in innovation while reinforcing its commitment to human rights and public trust. It offers a strategic blend of legal certainty and adaptive implementation.

Switzerland as a driver of AI-powered financial innovation

Pathway 2035 also highlights Switzerland’s distinctive assets. A study estimates that full-scale adoption of AI across sectors could add up to CHF 85 billion – or 11% – to national GDP over the coming years. AI is not only a driver of productivity and profitability, but also a lever to address structural challenges such as labour shortages, climate transition and research competitiveness.

Switzerland’s academic and technological infrastructure is world-class. Institutions like ETH Zurich and the Swiss National Supercomputing Centre provide the backbone for cutting-edge research. The recent arrival of global AI players such as OpenAI, Anthropic and Nvidia in Zurich only strengthens this positioning. To maintain its edge, however, Switzerland’s ecosystem must continue investing in AI infrastructure – including computing power and the development of locally hosted large language models – as part of a broader strategy for digital sovereignty. Promising examples in this respect are Phoenix Technologies or the Swiss AI Platform by Swisscom.

Switzerland is also expanding its global influence through AI diplomacy. In June 2025, the Federal Council decided to start preparations for an AI World Summit in 2027 to take place in Geneva, jointly organized by the Federal Department of the Environment, Transport, Energy and Communications (DETEC) and the Federal Department of Foreign Affairs (FDFA) in close collaboration with stakeholders from the scientific and business communities. Further, the International Computation and AI Network (ICAIN), supported by the FDFA, connects AI capabilities with sustainable development research across Europe and Africa. With access to two of the world’s most powerful supercomputers and a growing international network, ICAIN embodies how Switzerland merges technical expertise with multilateral engagement.

AI transforming Financial Services

Artificial Intelligence is no longer confined to the realm of experimentation in finance: it is actively transforming how financial services are designed, delivered and experienced. As outlined in Pathway 2035, intelligent systems are among the key drivers of this shift, enabling faster decision-making, deeper personalization and greater operational resilience. While regulation and governance remain essential pillars, much of AI’s potential lies in how it redefines the everyday financial journey for individuals and institutions alike.

Smarter Onboarding and Know-Your-Customer (KYC)

Customer onboarding has long been one of the most resource-intensive and error-prone processes in finance. Traditional KYC procedures involve a combination of manual data entry, document verification and risk assessment: a process that is costly for institutions and often frustrating for clients.

AI-powered onboarding streamlines this experience by automating identity verification through facial recognition, document analysis and real-time cross-checking with sanctions or watchlists. Machine learning models can evaluate user behaviour patterns, geographic data and transaction histories to build risk profiles more accurately than static rule-based systems. The result is a faster, more seamless onboarding experience that improves customer satisfaction while maintaining or even enhancing regulatory compliance.

Redesigning Customer Journey

On 26 June 2024, FIND hosted a workshop with thirty+ experts to explore what an ideal customer journey could look like in a modern Swiss financial ecosystem. The goal was to define a vision for Customer Journey 2.0 one that improves user experience through technology, while addressing the regulatory and business challenges linked to its implementation.

Discussions revealed a strong push towards faster, cheaper and more secure services, especially in cross-border contexts. Participants emphasized the importance of seamless digital experiences, inspired by models such as Norway’s e-ID infrastructure. Customers increasingly expect services that adapt to their needs, preferences and contexts not the other way around. Digital credentials and interoperable systems were seen as key enablers, particularly for onboarding.

In this context, it's worth noting that Switzerland's eID law is scheduled for a referendum in September 2025, which could significantly impact the future of digital identity infrastructure in the country. Several technologies emerged as foundational to this transformation: secure digital identity wallets with embedded authentication and verified credentials; APIs enabling full data portability; generative AI to enhance client interactions; and robust, cyber-resilient infrastructure. These tools, however, will require a shift in industry mindset, greater collaboration between actors and clearer incentives aligned with user needs. Questions remain around liability, data ownership and the financing of shared infrastructure.

The workshop concluded with a shared conviction: rethinking the customer journey is not just a matter of infrastructure, it is about redesigning the financial experience around trust, simplicity and proximity. In this context, intelligent systems are increasingly seen not only as tools, but as companions along that journey a shift explored in the next section (you will find more about the workshop here).

Intelligent Agents and the Rise of Personalized Financial Services

Until recently, interacting with financial institutions often meant navigating static FAQs, rule-based chatbots, or long waiting times on helplines hardly the intuitive, responsive experience users are beginning to expect. This is now starting to change. Advances in AI, particularly in natural language processing (NLP) and machine learning, are giving rise to a new generation of intelligent agents systems designed not only to respond, but to understand, anticipate, and eventually act.

While still emerging, these AI-powered assistants are already moving beyond simple Q&A scripts. Increasingly capable of interpreting intent and managing multi-step workflows, they are being integrated into core banking platforms to support tasks such as account inquiries, transaction categorisation, or even preliminary investment guidance. The promise is clear: 24/7 availability, reduced operational costs and richer user data feeding into continuous service optimisation.

What sets the most advanced prototypes apart is their growing ability to act proactively. A user expressing concern about monthly spending might, for instance, be offered automated budgeting options or nudged towards a personalised savings plan. These are early signs of a broader shift: one where financial services don’t just respond to needs they anticipate them.

This evolution lays the groundwork for what Citi has described as the “Do-It-For-Me Economy”, enabled by a rising class of agentic AI. In this emerging paradigm, users begin to delegate entire tasks to intelligent systems: rebalancing portfolios, managing subscriptions, planning expenses... These systems act not only as interpreters, but as executors capable of autonomous decisions within a defined scope of authority. While the full realisation of this vision is still ahead, first-mover institutions are already exploring how to embed these agents securely and meaningfully into the user journey.

Alongside this shift in execution lies a parallel transformation in user empowerment. Intelligent agents hold great potential as financial coaches – guiding users through decisions, simplifying complex terms, and even adapting educational content to individual goals. Some banks are experimenting with interactive simulations, gamified savings tools, or step-by-step onboarding guidance powered by AI. These developments aim to make financial services not only more efficient, but also more inclusive and confidence-building.

In sum, intelligent agents are reshaping the contours of financial services – not with one giant leap, but through a series of incremental, human-centred evolutions. From conversational support to task delegation and personalized coaching, they signal a move towards services that are adaptive, anticipatory and fundamentally designed around the user.

Risk Management and Predictive Analytics

Beyond front-end services, AI is also transforming back-office operations – especially in risk management. Machine learning models are increasingly used to detect fraud, credit risk, predict loan defaults, assess portfolio volatility and even evaluate geopolitical or environmental risks that may affect investment strategies.

Unlike traditional models, which rely on historical averages and linear assumptions, AI models can process real-time market data, news sentiment and even satellite imagery to generate multidimensional risk assessments. This enables financial institutions to be more proactive in their strategies and better prepared for market shifts.

Fraud detection and deepfake identification represent particularly emerging challenges in this landscape. This was notably addressed in one of the challenges presented by Julius Baer at the first edition of SwissHacks in 2024, the first hackathon focused on financial innovation initiated by FIND. Participants were tasked with developing a "Fake Sniffer" to identify deepfake calls and verify client identity in real-time, with the winning solution FraudFence demonstrating how deep learning techniques can be turned against fraudsters.

Ethical Considerations and Trust

As AI becomes more central to financial services, ethical concerns cannot be ignored. The use of personal data, algorithmic decision-making and opaque model logic raises critical questions about fairness, transparency and accountability.

Institutions must implement strong governance frameworks, including explainability requirements, bias audits and user consent mechanisms. The notion of "trustworthy AI" – an important concept in the European AI Act and echoed in Switzerland’s evolving regulatory stance is especially crucial in finance, where decisions can have profound impacts on individuals’ economic well-being.

AI and Smart Finance

From Data to Intelligence

AI is no longer just a lever of process innovation in finance – it is becoming a structural catalyst, transforming the very logic of financial systems. This shift is the focus of FIND’s recent deep dive, Building Blocks for Smart Finance in Switzerland, which expands on the strategic vision laid out in Pathway 2035. The publication articulates a new conceptual lens: Smart Finance, a paradigm where AI, data and interoperability converge to reshape financial infrastructure.

Concepts like open banking, embedded finance or open data have paved the way for more connected services, but they often remain limited in scope. Smart Finance calls for a broader, integrated transformation – one where AI is not simply added on top of legacy systems but woven into the financial architecture itself. In this model, intelligence is not reactive but anticipatory, enabling financial services to adapt dynamically to user needs, institutional priorities and regulatory requirements.

At the heart of this transformation lies a simple yet powerful question: How can Switzerland build a future-proof financial system that uses data as a strategic resource – without sacrificing market-driven principles or digital self-determination?

Intelligence Through Architecture

Smart Finance is not about individual applications of AI it is about designing a new kind of infrastructure. One that is modular, data-centric and capable of supporting real-time learning and adaptation across the ecosystem.

This vision emerged clearly during the FIND workshop "Pathway for Financial Services Integration", held in Bern in February 2025, which brought together public and private actors to explore gaps and opportunities in Switzerland’s financial landscape. Participants emphasized the need for foundational infrastructure: secure data environments, standardized APIs and trusted digital identity frameworks. But they also highlighted a deeper challenge the need to move beyond fragmentation and orchestrate systems that are interoperable, user-centric and innovation-ready.

The Smart Finance publication builds on these insights and proposes a next-generation architecture based on six strategic pillars: targeted regulation, public-private governance, international alignment, data security and digital self-determination, innovation acceleration, and awareness and engagement. Each of these elements is essential to move from scattered pilots to a truly smart ecosystem.

Strategic Pillars for Smart Finance

Source:FIND

Data Infrastructure as a Strategic Asset

If data is the fuel of Smart Finance, then infrastructure is the engine. The ability to extract intelligence from data safely, efficiently and ethically depends on robust, shared infrastructure that spans institutions, sectors and borders.

Switzerland already has strong assets, including initiatives such as bLink, the Common API framework and a vibrant fintech ecosystem. But scaling intelligence across the financial system will require more trusted environments for data exchange, reinforced identity and authentication layers, and governance mechanisms that enable consented data sharing while protecting users’ rights.

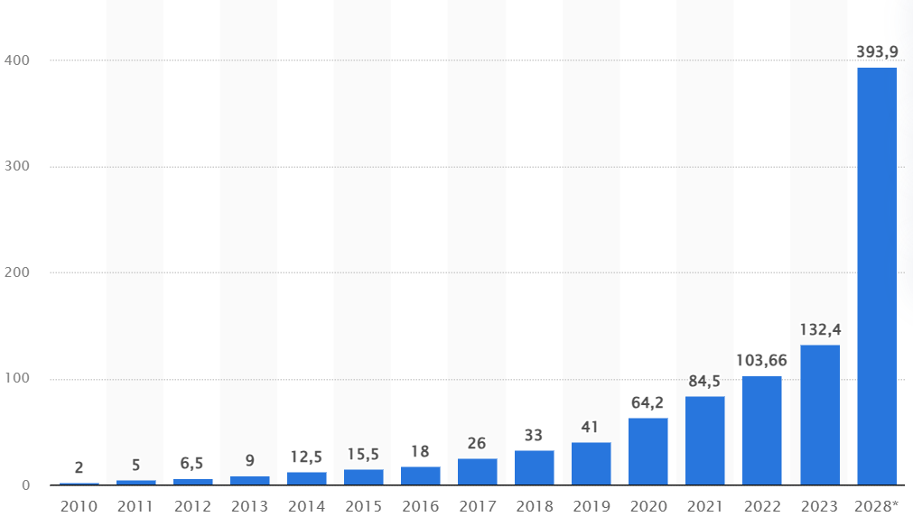

This is not a purely technical agenda. It is a question of sovereignty and competitiveness. Countries that manage to align innovation with ethical data governance will shape the next decade of finance. As the Smart Finance publication notes, we are entering a phase where more data will be generated in the next three years than in all human history (see also Statista illustration below). Most of it will be financially relevant. Controlling how that data is captured, processed, and applied will define leadership both economic and regulatory.

Volume of digital data generated/replicated annually worldwide from 2010 to 2023 and forecast for 2028 (in zettabytes)

Source:Open Finance Meets Embedded AI

Smart Finance sits at the crossroads of two major movements: open access to data and embedded intelligence in services. Open Finance, building on the foundations of open banking, allows for secure and user-consented data portability across institutions. It gives rise to new services such as real-time credit scoring, predictive financial coaching, or hyper-personalized wealth management.

Embedded Finance, meanwhile, pushes financial services into non-financial platforms from mobility apps to e-commerce or health portals blurring the boundaries between industries. Add AI to this mix, and the result is ambient finance: intelligent systems that operate in the background, anticipating user needs, automating choices and enhancing everyday decisions.

For example, an AI-powered agent embedded in a budgeting app might suggest adjusting savings goals after detecting a change in salary or propose a cheaper insurance option after analysing driving habits. These are no longer isolated tools: they are components of an integrated financial journey, shaped by data and guided by intelligence.

The Swiss Way: Modular, Market-Driven and Trust-Based

Switzerland’s approach to Smart Finance is both pragmatic and principled. Rather than enforcing top-down reforms, FIND advocates for a modular and market-driven transformation, anchored in strong public-private dialogue and respect for digital self-determination.

Key actions outlined in the Smart Finance publication and further discussed during the related workshop include:

advancing shared infrastructure for anti-money laundering (AML) data,

establishing hybrid governance models through public-private partnerships,

launching Smart Data Challenges to stimulate bottom-up innovation,

and fostering structured experimentation via regulatory sandboxes.

This Swiss model does not reject regulation, it seeks to target it strategically, encouraging responsible innovation without stifling agility. Central to this vision is the idea that trust is not a by-product it is the infrastructure. Without user trust, no intelligent system will gain scale or legitimacy. Smart Finance must therefore reconcile efficiency with transparency, accountability and sovereignty.

From Technical Agenda to Strategic Imperative

The transition to Smart Finance is not just a matter of upgrading infrastructure, it is a strategic imperative for national resilience and competitiveness. AI enables the orchestration of adaptive, predictive and personalized financial services. But this transformation will only succeed if supported by the right frameworks: open standards, ethical data governance, interoperable platforms and sustained collaboration between public and private actors.

FIND’s Smart Finance roadmap provides a solid foundation for this transition. But the work is just beginning. As the report emphasizes, building intelligent financial systems is not a goal in itself it is a means to empower users, foster innovation, and reinforce the credibility of Switzerland as a global financial hub. The future of finance will be smart. The question is: will it also be trusted, human-centered and sovereign?

The Regulatory Edge: AI for Compliance and Financial Crime Prevention

Current AML/CFT oversight regulations have at times been described as ‘the world's least effective policy experiment’ (see article by Ronald Pol of 2020). It is estimated that each year, between USD 800 billion and USD 2 trillion in illegal funds move through the global financial system. However, even though more than USD 200 billion is spent worldwide every year on AML/CFT compliance, research shows that less than 1% of these illegal funds are actually detected and stopped. Even when suspicious activity is reported, authorities often struggle to handle and understand the huge amount of data. This problem is made worse because reporting systems are not well connected and old methods of analysis are limited for details and source information see report of Digital Euro Association Group, p. 31).

In 2023, Europol’s report “The other side of the coin: an analysis of financial and economic crime in the EU” came to a similar result: 98% of illegal funds in the international financial sector remain undetected. This means that less than 2% of the estimated annual profits from organized crime are actually recovered from criminal groups – “a drop in the ocean of the immense illicit – and untaxed – revenues gained by criminal networks” to quote Europol’s executive director..

Over the past few years, Switzerland has been criticized several times by the Financial Action Task Force(FATF) for its efforts to combat money laundering, terrorist financing and other threats. According to the FATF's latest report, Switzerland's system for combating money laundering and terrorist financing is technically sound.

Switzerland’s framework for combating financial crime is evolving, with AI playing a pivotal role in enhancing more efficient and effective compliance and fraud detection. By leveraging AI technologies, Swiss institutions hold great potential to increase efficiency, improve transparency, and stay ahead of complex regulatory challenges in a dynamic global landscape. Who knows, AI might bring Switzerland from technically sound to superbly excellent and also substantially increase the effectiveness of the global fight of AML/CMT.

Current regulatory situation in Switzerland

In May 2024, the Federal Council adopted a bill to enhance Switzerland's anti-money laundering framework, focusing on a federal register of beneficial owners, due diligence for high-risk legal professions, and other measures aligned with international standards. It will be submitted to parliament and is expected to take effect in 2026 at the earliest.

The bill aims to prevent financial crimes and protect the integrity of Switzerland's financial system by increasing transparency and tightening regulations, particularly in legal and advisory services.

In these specific industries, the planned revision of the Anti-Money Laundering Act (AMLA) has leveled criticism at the complexity of the law, which could lead to unintentional misconduct and undermine trust in Swiss lawyers due to an unclear distinction between the reporting requirement and professional confidentiality.

The role of AI in compliance and fraud detection

Indisputably, AML regulations are becoming increasingly complex, requiring banks and other related industries to play a central role in detecting and preventing fraudulent activities. Financial crime prevention demands precision and adaptability to meet evolving regulatory standards.

The solution is not just to improve the effectiveness of existing reporting requirements; technological support can also help to deal with the increasing complexity or implement new rules. AI solutions can further play a crucial role by enhancing efficiency in these processes. They enable faster, more accurate detection of suspicious activities, automate routine compliance tasks, and provide real-time insights. This allows organizations to stay ahead of regulatory demands while reducing costs by mitigating risks before they materialize.

How does AI Work in AML Compliance and Fraud Detection?

Artificial Intelligence has transformed compliance and fraud detection by enabling advanced data analysis and aggregation. By processing large volumes of structured and unstructured data, AI systems identify patterns, suspicious transactions and anomalies that may signal money laundering or fraudulent activities. This capability helps uncover risks that traditional methods might overlook, enhancing the overall effectiveness of compliance measures.

Machine learning models play a critical role in this transformation. These models are trained on historical data to detect suspicious behaviors with high accuracy. Over time, they adapt to new fraud techniques and money laundering methods, ensuring that detection capabilities remain relevant and effective in an evolving threat landscape.

Real-time monitoring is another key advantage of AI in compliance. AI systems continuously analyse financial transactions and flag suspicious activities as they occur. This immediate detection significantly reduces response times, allowing organizations to intervene quickly and minimize potential damage.

Finally, AI simplifies regulatory reporting by automating the preparation of Suspicious Activity Reports (SARs). It streamlines data collection and report generation, ensuring submissions are both timely and accurate. This automation improves compliance efficiency and frees up valuable resources for other critical tasks.

Risks and challenges of using AI in compliance

AI in compliance and fraud detection offers immense potential but comes with challenges that organizations must address. One critical issue is bias in detection algorithms, where skewed or incomplete training data can lead to unfair targeting of certain customer groups. This not only risks reputational damage but also raises ethical concerns. Additionally, privacy concerns loom large as organizations must navigate stringent data protection laws, such as GDPR, while leveraging AI technologies for AML and compliance efforts.

Another significant challenge is regulatory ambiguity, with evolving expectations from authorities on how AI systems should be designed and implemented in compliance processes. Without clear guidelines, organizations may struggle to ensure that their AI-driven compliance systems align with legal and ethical standards. Furthermore, over-reliance on automation poses risks, as nuanced cases require human judgment to avoid errors or oversights that AI alone might not catch.

Finally, integrating AI systems with existing banking infrastructure adds complexity. Many legacy systems are not designed for seamless AI integration, creating operational and technological hurdles. Addressing these integration challenges while balancing automation with human oversight is essential to fully realizing the benefits of AI in compliance and fraud detection.

Best practices for the banking sector leveraging AI in AML

Effective use of AI in compliance and fraud detection requires a risk-based approach. By tailoring AI models to prioritize high-risk transactions and customers, organizations can focus resources where they are most needed. This strategy ensures a more targeted and efficient detection process, reducing false positives and improving overall compliance efforts.

Transparency in AI models is another crucial element. Developing explainable AI systems allows regulators and auditors to understand how decisions are made, fostering trust and accountability. Clear documentation of detection processes ensures regulatory alignment and helps organizations defend their actions during audits or investigations.

To stay effective, AI models must undergo ongoing training and calibration. Regular updates ensure these systems adapt to new money laundering and fraud techniques, keeping detection capabilities robust. Collaboration with regulators further strengthens AI’s role, as proactive dialogue ensures compliance processes align with evolving legal and ethical standards. Together, these practices create a comprehensive and reliable framework for leveraging AI in compliance.

The current state of the use of AI in compliance in Switzerland

Switzerland is actively integrating AI into its financial sector to enhance compliance and fraud detection. In 2024, the Swiss Financial Market Supervisory Authority (FINMA) released Guidance 08/2024 on governance and risk management for artificial intelligence (AI) applications in supervised financial institutions and outlining its expectations when supervised financial institutions use AI applications. The guidance builds on earlier FINMA statements in its Risk Monitor 2023, where it emphasized robust governance, transparency, and the avoidance of discrimination. This regulatory framework ensures that AI systems are reliable and align with ethical standards.

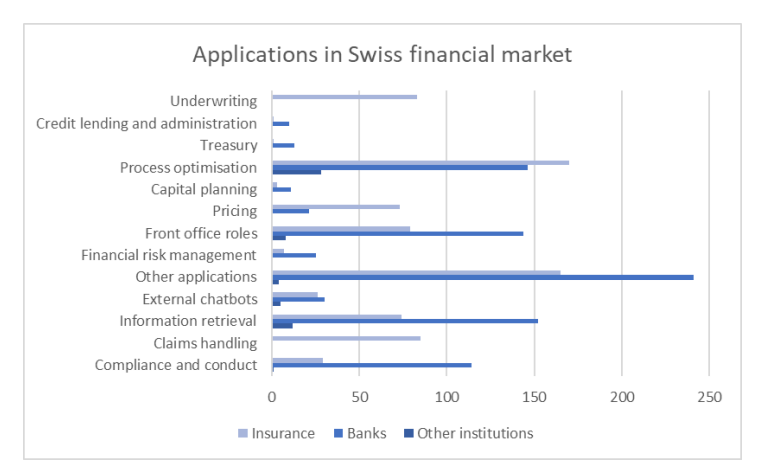

Simultaneously, Swiss companies are increasingly adopting AI-driven Regulatory Technology (RegTech) solutions to streamline compliance processes and reduce operational costs. These solutions facilitate adherence to both Swiss regulations and international standards, such as the EU AI Act. By leveraging AI, Swiss financial institutions are better equipped to prevent financial crimes and ensure compliance in a complex regulatory environment. A FINMA survey of 400 financial institutions evidences this finding: AI applications for compliance are ranked fifth.

Source: FINMA Press Release (April 2025)

Future Trends in AI for AML Compliance and Fraud Detection

AI is increasingly playing a vital role in advanced predictive analytics, enabling organizations to forecast fraud trends and money laundering risks more accurately. By analyzing historical data and identifying patterns, AI helps institutions anticipate potential threats before they occur. This proactive approach strengthens fraud prevention and enhances the overall efficiency of compliance strategies.

The integration of AI with blockchain technology is further transforming compliance and fraud detection. Blockchain’s inherent transparency and traceability, combined with AI’s analytical power, create a robust system for monitoring transactions. This synergy ensures greater accountability and simplifies the tracking of suspicious activities across decentralized networks, making it a valuable tool for combating financial crime.

RegTech solutions are also emerging as a game-changer in AML compliance. These solutions streamline compliance processes, reduce operational costs and enhance accuracy in meeting regulatory requirements. Additionally, AI fosters global collaboration by enabling cross-border data sharing and joint efforts in financial crime prevention. This collective approach strengthens international frameworks for combating fraud and money laundering.

From Vision to Action: Learning From Others

As AI becomes progressively embedded in the architecture of the global financial system, Pathway 2035 and its deep dives including Building Blocks for Smart Finance in Switzerland offer both a compass and a call to action. The future of finance will not be determined by technology alone, but by the strategic, institutional and ethical choices made today. Aligning innovation with public value, interoperability with sovereignty and experimentation with trust has become a defining challenge for the coming decade.

Yet this transformation cannot and should not happen in a silo. To fully grasp the potential of AI, the financial sector must look beyond its own reflexes and regulatory frameworks and draw inspiration from other industries already navigating similar transitions.

This is the idea that underpins FIND’s article, Cross-Sector AI Insights for Financial Innovation, which emerged from our participation at the Swiss NLP Expo 2025. The publication explores how healthcare, law, fashion, logistics and tech are deploying AI not just to automate, but to rethink value chains, user relationships and governance models. It highlights key advances in areas such as intelligent document processing, hyper-personalization, strategic data integration and agile experimentation.

These cross-sector lessons resonate strongly with the challenges facing finance today. They point towards a bolder, more collaborative future one where intelligent agents don’t just assist, but co-pilot decisions; where data infrastructure becomes a shared common; and where innovation is anchored in real-world utility and user empowerment. Building a smart, inclusive and resilient financial system is not just a technological journey, it’s a collective, cross-sectoral one.

Further information and research about AI & Compliance

Nicola, Henrietta. (2024). Harnessing AI and Predictive Analytics for Robust Anti-Money Laundering and Risk Mitigation in FinTech. 10.13140/RG.2.2.11513.28005.

http://dx.doi.org/10.13140/RG.2.2.11513.28005

Sharma, Rohit. (2024). Revolutionizing Anti-Money Laundering in Banking with Artificial Intelligence and Data Analytics.

https://www.researchgate.net/publication/384324700_Revolutionizing_Anti-Money_Laundering_in_Banking_with_Artificial_Intelligence_and_Data_Analytics

Daneshmand, Mahmoud & Ranjan, Piyush & Khunger, Akhil & Dahiya, Sumit. (2024). Harnessing AI and ML for enhanced financial risk management: opportunities and challenges. 56. 15.

https://www.researchgate.net/publication/386425318_HARNESSING_AI_AND_ML_FOR_ENHANCED_FINANCIAL_RISK_MANAGEMENT_OPPORTUNITIES_AND_CHALLENGES

Shafin, K.M., Reno, S. Integrating blockchain and machine learning for enhanced anti-money laundering system. Int. j. inf. tecnol. (2024). https://doi.org/10.1007/s41870-024-02318-7

Carucci, Céline. (2024). Anti-money laundering in the age of cryptocurrencies. 10.36862/eiz-ng010.

https://eizpublishing.ch/wp-content/uploads/2024/11/Anti-money-laundering-in-the-age-of-cryptocurrencies-Digital-V1_00-20241108.pdf

Swiss Government: Federal Council adopts dispatch on strengthening anti-money laundering framework (22.5.24): https://www.admin.ch/gov/en/start/documentation/media-releases.msg-id-101100.html

Swiss Banking, Expert Report, Generative AI in Banking, A Comprehensive Overview, April 2025: https://www.swissbanking.ch/_Resources/Persistent/2/0/3/b/203b937e175f25819ea271c883a095fe1dfa1ee0/SBA_Generative-AI-in-Banking_EN.pdf

A Scalable Framework for Implementing - Artificial Intelligence in Swiss Financial Institutions', Whitepaper from SFTI and OST.

Management-Summary_AI-Scalable-Framework-for-Swiss-FI_V1.0-FINAL.pdf